Early career Emergency Medicine physician trying to navigate the financial world

- January 2026 Update

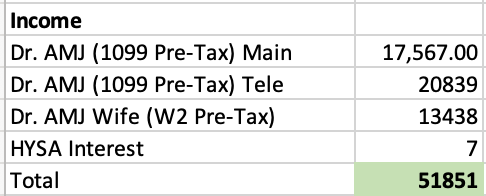

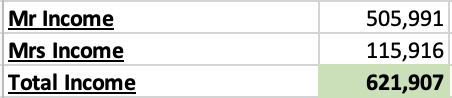

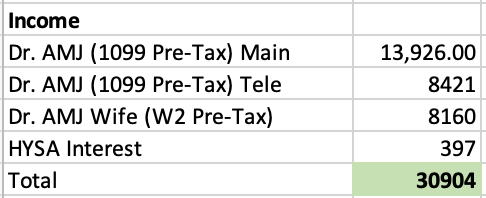

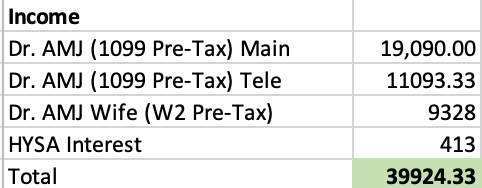

January Total Income:

We are off to a good start for 2026, my wife got three paychecks this month so her income ended up being a little higher than usual. I continue to work several “PRN” or part-time jobs via telemedicine and various local ER gigs. So far, I am much happier with this hybrid schedule.

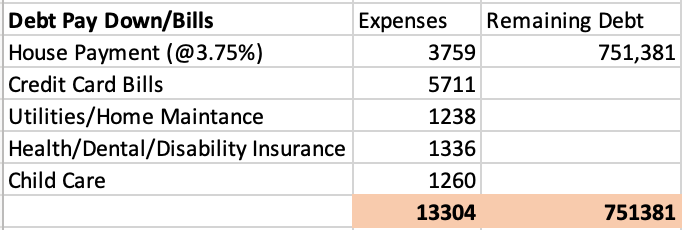

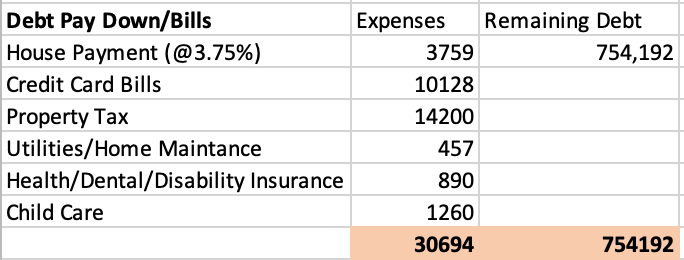

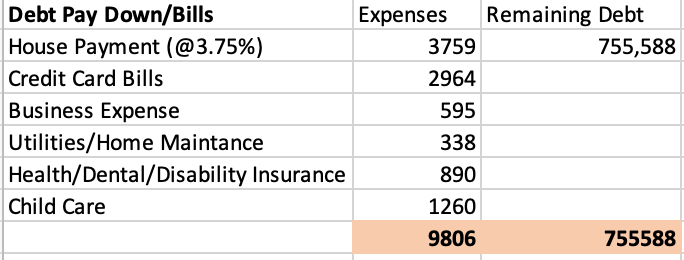

Expenses

We had several maintenance items come up this month, often saying to myself, “the joys of homeownership”. pluming issues, dryer vent issue, landscaping upgrades, thankfully nothing major but enough to up our usual expenses for the month.

Investments

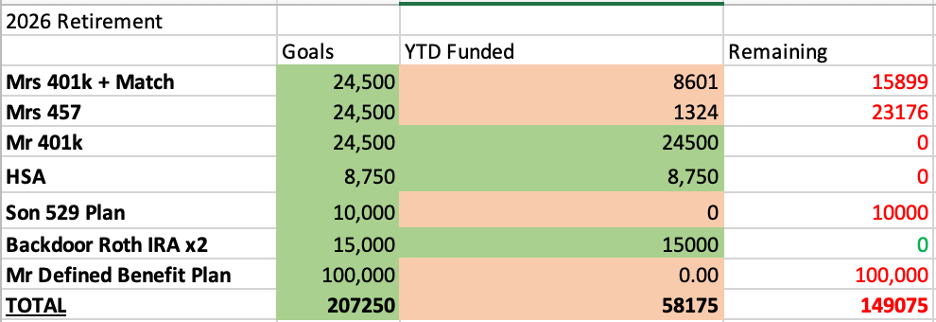

We continue to aggressively invest every dollar we can. I emptied out our HYSA to deploy into our retirement accounts:

HSA, my 401k, Backdoor Roth IRA x2 all maxed this month. My next goal will be max out my DB plan for the year which will take at least 4-5 months as I have a goal of 100k in that account for the year (I get my final numbers at the end of the year but prefund most of it).

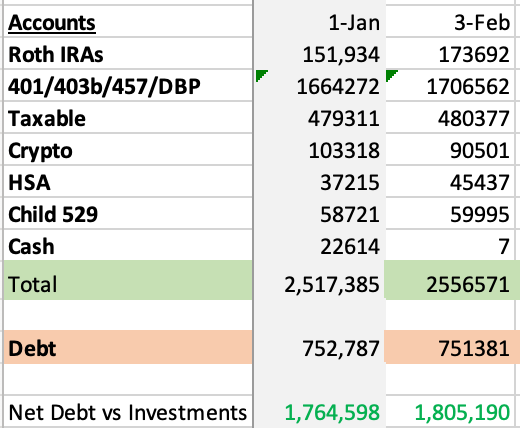

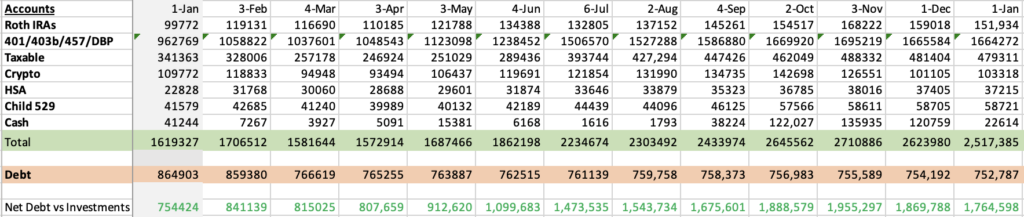

Investment Accounts:

A net gain of $41k for the month.

My Financial Goals for 2026

- Hit $3 million in investments: We are currently at the $2.5 mil range, contributions continue to go in every month, need some growth in the market to achieve this goal.

- ?Pay down mortgage and recast. Our mortgage has a rate of 3.75%. My wife and I have entertained the idea of paying it down a bit and recasting to drop the payment in case something ever happens to one of us. Our current payment is around $4k/month.

- Obtain umbrella insurance – Expensive in my home state (almost 1k for the year), I haven’t been able to bring myself to buy it yet, but I know I need to. This year is the year!

-AMJ

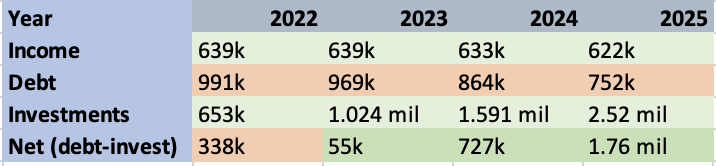

- How we spent 600k in 2025

About me: I am a full-time emergency medicine doctor a few years out of residency (finished in 2020, currently 37 years old). I currently work in various emergency departments as a 1099 contractor and have a few telemedicine side gigs. I am married to my beautiful wife, Mrs. AMJ and have one child. I created this blog to track my financial journey. My goal is to maintain a balanced approach to my finances between slowly paying down my low interest debt, investing aggressively, but also enjoying life along the way (IE: Somewhere between frugal and YOLO). Thank you for following along.

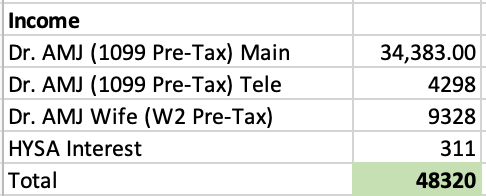

2025 Total Income*

*This represents our income from working our regular jobs.

2025 Other Income:

This year was a messy one with a lot of good times but a lot of hard times. I paid off my remaining student loans ( $100k this year, approximately $301k in total), we dramatically grew our stock market portfolio by almost $1 mil. I also lost a close family member and this being a financially focused blog, I received a moderate inheritance (around $300k). I started working for another nearby ER group part time and also grew my telemedicine work, this allowed me to drop to part time/PRN at my main job which I had been working fulltime for the last two years. For various reasons, I had become unhappy/annoyed at the main job and having other gigs/income while making huge strides financially allowed me to step back a bit. My wife also continues to work a part time w2 job which gives us great benefits and allows me the flexibility to work as a 1099 contractor. Financially, we are in a much better place than we were just a year ago.

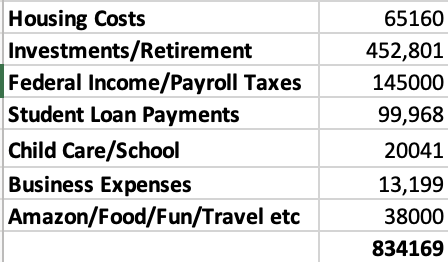

Excluding the Inherited IRA, I had $834k in cash to work with. Let’s run through where all this month went:

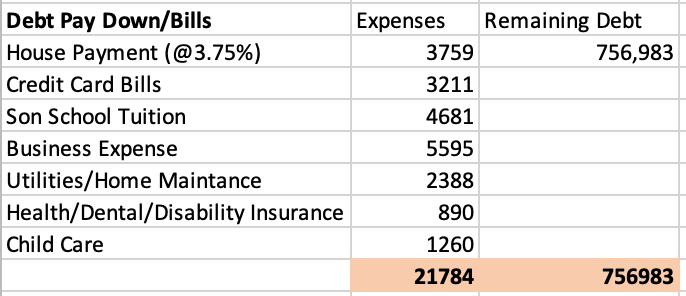

Lets’ go through each line item:

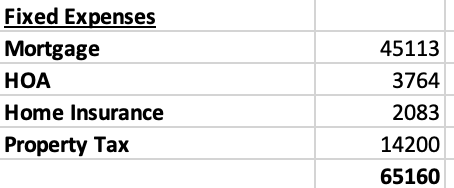

Housing:

Despite living in Florida, our insurance is reasonable, this does not include flood insurance (we do not carry). We thankfully did not have any major expenses or repairs this year (We custom build a home in 2022-2023 thus everything is still new).

I finally paid off my student loans. I started the year with 100k left and two years left of a 5 year payment plan at 1.1%. I invested about 10k in PLTR stock over the past few years and the stock skyrocketed. Once that stock became almost equivalent to my remaining student loans and said screw it and I sold all my PLTR and wiped out my student loans for good. Some regret as PLTR continued to skyrocket and I could have sold with an additional $50k gain later this year, but the payments were bigger than our mortgage so it really cut our living expenses in half by not having that monthly payment.

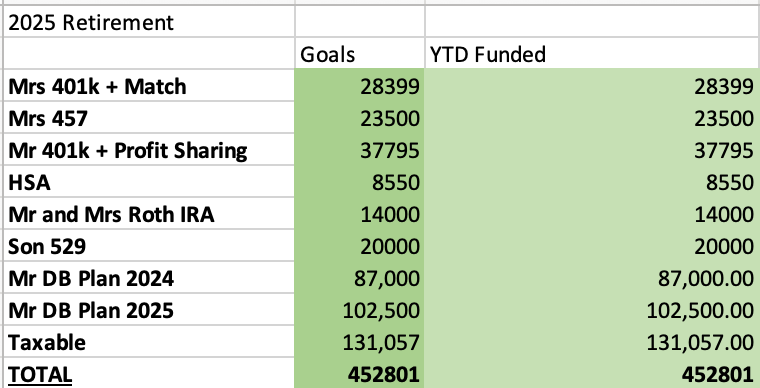

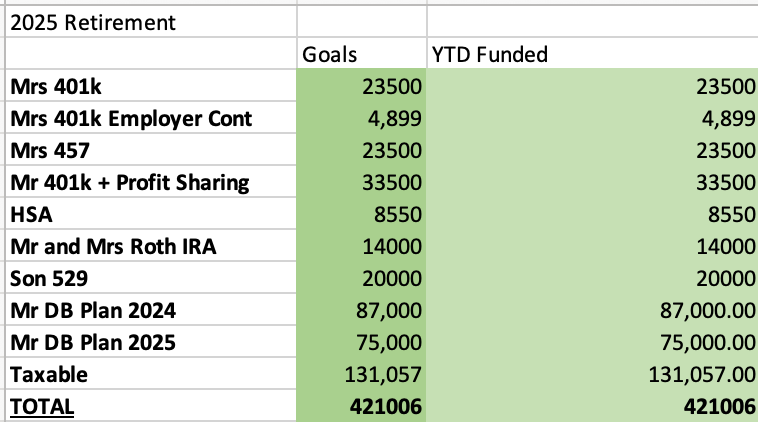

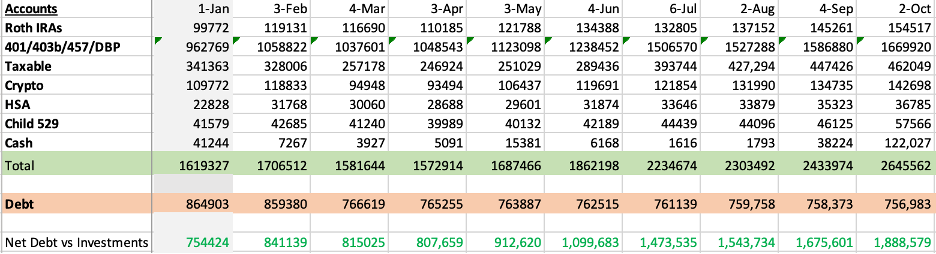

Above is a breakdown of our investments. I work as a 1099 contractor and have set up a solo 401k plus a DB Plan. This allows me to invest much more pretax than I otherwise would be eligible for. I had not yet funded any of my 2024 plan so I funded that amount and then funded the rest for 2025 before the end of the year. My wife has a standard 401k with small match and a 457 plan we max. I have a goal to contribute 10k each year for my sons college fund (goal is 18 years at 10k = 180k contribution) and I contributed 20k this year. We do backdoor Roth IRAs and max our family plan HSA as well. Anything extra, we put in our taxable account. Some of this taxable money was related to inheritance received, all total I contributed $452k.

Our tax payment bill was much bigger than I wanted but part of this was an additional 20k or so required for the PLTR sale (LTCG 15% plus NIIT tax).

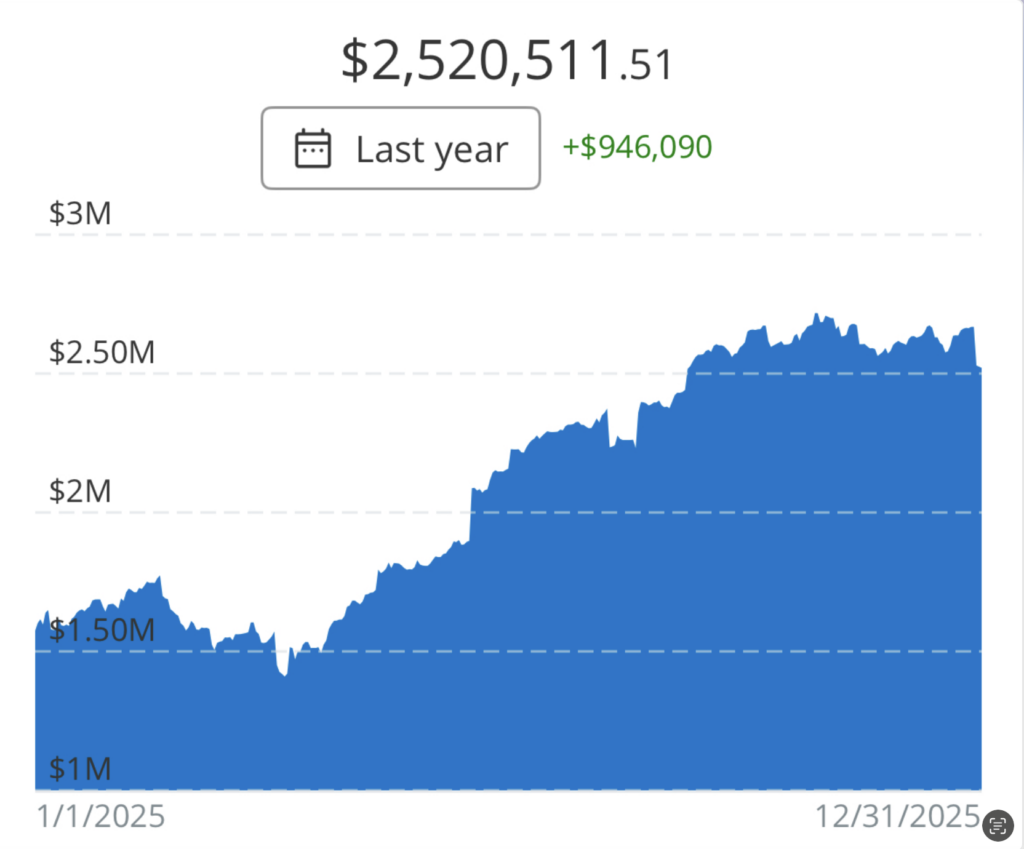

Our investment gains for the year are $388,431 when you include PLTR stock sale profits.

Child care came in around 20k as our son goes to part time school (daycare really) and we have a nanny for two days a week when we are both working. We are discussing full time school next year and this will slightly drop cost for us as home nanny is much more expensive.

Business expenses were fairly standard for the year, CPA, taxes, LLC, licensing, credentialling all adds up.

The rest covers really food/living expenses etc. We took only one “expensive” vacation that cost about 6k, otherwise we visiting family or traveled locally thus our day-to-day expenses at home are fairly low.

Investments:

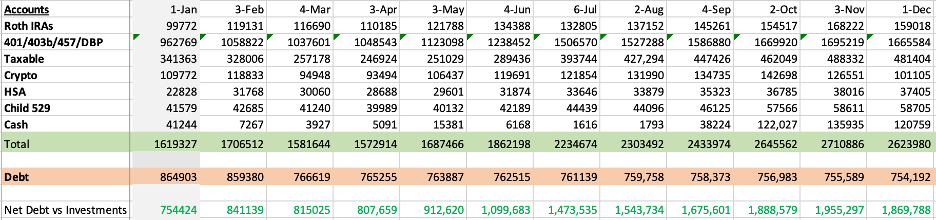

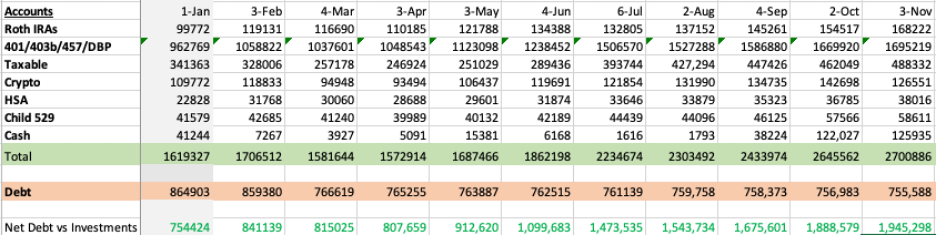

Investment Account Breakdown

My mind is blown at how much progress we have made since just 2-3 years ago. Compound interest and snowballing really starts to take effect once you cross $1 mil.

Lets look back at my financial goals for 2025

- Hit $2 Million in investments. Currently at approximately $1.6 mil, I plan to put in at least 200k, that requires a market return of about 10% to get me to $2 mil.

- Goal hit and we crossed $2.5 mil

- Pay off remaining student loans. I start the year with ~$95k left in student loans refinanced to 1.1%. I know mathematically it makes zero sense, but I only have two years left on them regardless. I plan to fully fund my retirement accounts in the first quarter of 2025 and then have them gone by midway through the year.

- Goal hit in February as I sold off my PLTR stock and made one final lump sum payment

- Work less? I said that last year, didn’t happen.

- Finally, can say I am doing this

Looking forward to financial goals for 2026.

- Hit $3 million in investments: Currently just over $2.5 and I hope to contribute at least 200k this upcoming year. Will need a little bit of growth in the market but it seems doable.

- ?Pay down mortgage and recast. Our mortgage has a rate of 3.75%. My wife and I have entertained the idea of paying it down a bit and recasting to drop the payment in case something ever happens to one of us. Our current payment is around $4k/month.

- Obtain umbrella insurance – Expensive in my home state (almost 1k for the year), I haven’t been able to bring myself to buy it yet, but I know I need to. This year is the year!

I cut back from full time emergency medicine work starting in October and I feel so much better, happy and healthier. I am now able to exercise consistently each week. I get to spend a lot of time with my son and my relationship with my wife has also much improved with the decreased clinical load. While this blog remains financial in nature, ultimately what matters in life is your health and relationships with the people that truly love you. Growing and securing my financial future has dramatically changed my life for the better.

Thanks for following!

-AMJ

- Hit $2 Million in investments. Currently at approximately $1.6 mil, I plan to put in at least 200k, that requires a market return of about 10% to get me to $2 mil.

- November 2025 Update

November Total Income:

November has been our lowest income month by far. We took a lot of time off in October and early November for vacation and family time so I didn’t work much resulting in a lower November paycheck. HYSA is now down to 3.6% yield, just a year ago, they were over 5%. I mainly keep this account as a cash reserve and to also save up for my tax payments.

Expenses

Had several extra large payments this month. Yearly property tax was due and then larger than normal credit card bills due to our recent vacation and birthday party for my son. I used some of our cash savings to our property tax so didn’t come from our income this month.

Investments

November was a volatile month for the market, it dropped quite a bit but then had a decent recovery into the end of month. I own a fair amount of crypto and with bitcoin dropping below 100k, this dropped my accounts for the year.

I received my final tax planning numbers for my 401k and DB plan for the year and contributed the final amounts to those accounts. I don’t know if I will ever save so much money in a single year, it was a combination of different factors between inheritance, continued high income and no major expenses allowing us to save so much. I am planning to work less clinically next year as our finances continue to improve so saving this much next year is unlikely.

Investment Accounts:

First month this year where my net worth dropped, again mainly due to the crypto pullback. I continue to HODL and hope we have a solid recovery into the end of the year.

My Financial Goals for 2025

- Hit $2 Million in investments. DONE

- DONE- PAID OFF IN FEBURARY!!!! Pay off remaining student loans. I start the year with ~$95k left in student loans refinanced to 1.1%. I know mathematically it makes zero sense, but I only have two years left on them regardless. I plan to fully fund my retirement accounts in the first quarter of 2025 and then have them gone by midway through the year.

- Work less? DONE October begins my transition to hybrid EM and telemed work. I’ll likely see a drop in my income, but I am ok with that.

-AMJ

- October 2025 Update

October Total Income:

October 2025 was my first month working as a “part-time” ER doctor. I only worked 7 clinical shifts and did a bit of telemedicine on the side. We also took almost two weeks off for vacation and my son’s birthday party which was honestly, wonderful. Thus, our income dipped a bit this time, but I do feel like we are getting to a place were we can start to pull back just a little bit.

Expenses

This month was about the lowest spending we can get without any major bills due. I am due to renew my state medical license so I had to pay some fees for that. Next month will be a different story as most of our vacation and sons birthday party expenses will be due as well as property taxes for the year 🙂

Investments

This month, we hit $2.7 million in the stock market! Now up over $1.1 YTD. We continue to get positive returns in the market. SP500 gained 2.3% for the month of October. It has been a wild year in the stock market but just staying the course and continuing to buy remains a winning formula.

I added another $10k into our taxable account this month, otherwise I continue to grow our cash position as we have our large end of year S corp tax bill looming and then also holding some cash for deployment in January into our retirement accounts.

Investment Accounts:

A net gain of $56k for the month. While equity markets grew, crypto dipped a bit causing a draw down in some of my accounts.

My Financial Goals for 2025

- Hit $2 Million in investments. DONE

- DONE- PAID OFF IN FEBURARY!!!! Pay off remaining student loans. I start the year with ~$95k left in student loans refinanced to 1.1%. I know mathematically it makes zero sense, but I only have two years left on them regardless. I plan to fully fund my retirement accounts in the first quarter of 2025 and then have them gone by midway through the year.

- Work less? DONE October begins my transition to hybrid EM and telemed work. I’ll likely see a drop in my income, but I am ok with that.

-AMJ

- September 2025 Update

September Total Income:

September was my last month working “full time” in emergency medicine. I am still planning to work about half time (IE: around 8 shifts a month) in the emergency department and then will be supplementing with some telemedicine work. This will likely drop my income a bit, but I think we are in a financial place that I can start doing that. It gets me out of night shifts by working part time/PRN, at least for now. As long as I can keep my telemed income going, I should be good to continue.

Expenses

Big spend month for us, our son’s yearly tuition was due, several home and boat maintenance items/issues. Additionally, I paid for my yearly tax planning/CPA fee for my 1099/S-corp. Next month, we will have our property tax due so still have lots of big money items on the list for the year.

Investments

September was another solid month in the market. SP500 gained 3.5% and we remain fully invested. I also received a $70k inheritance check that I added to our HYSA, this will mainly be used to pay our end of year tax bills.

The only additional investment contribution we made this month was adding 10k to our son’s 529. I have a goal to invest $180k (10k for 18 years) and I have the extra cash right now so I added on another 10k ($20k for the year). Any extra cash we kept in our HYSA.

Investment Accounts:

A net gain of $212,970 for the month. Once you build that nest egg (which I feel like is really the first million), the power of compound interest starts to hit.

My Financial Goals for 2025

- Hit $2 Million in investments. DONE

- DONE- PAID OFF IN FEBURARY!!!! Pay off remaining student loans. I start the year with ~$95k left in student loans refinanced to 1.1%. I know mathematically it makes zero sense, but I only have two years left on them regardless. I plan to fully fund my retirement accounts in the first quarter of 2025 and then have them gone by midway through the year.

- Work less? DONE October begins my transition to hybrid EM and telemed work. I’ll likely see a drop in my income, but I am ok with that.

-AMJ