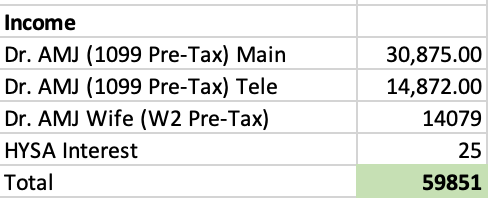

January Total Income:

We had a great start to the year. My wife got paid three times in January and she is aggressively funding her retirement accounts to start the year. I had a solid month, busy with shifts, I am doing more telemedicine and providing a surprisingly high income which I’m happy with for now. I also started a new PRN gig in another local emergency department, I haven’t gotten paid for these shifts yet (get paid RVU bonus a few months later) so this will drop my income slightly until I get paid out.

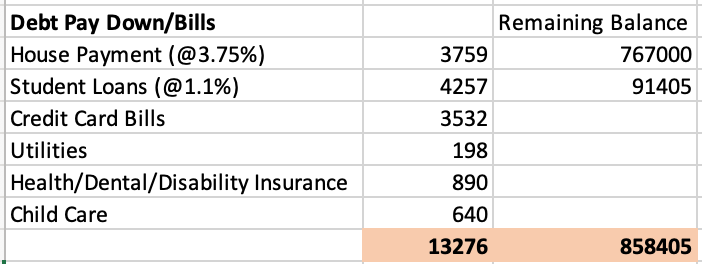

Expenses

A standard month for us expense wise, continue to make minimum payments on my student loans and our mortgage.

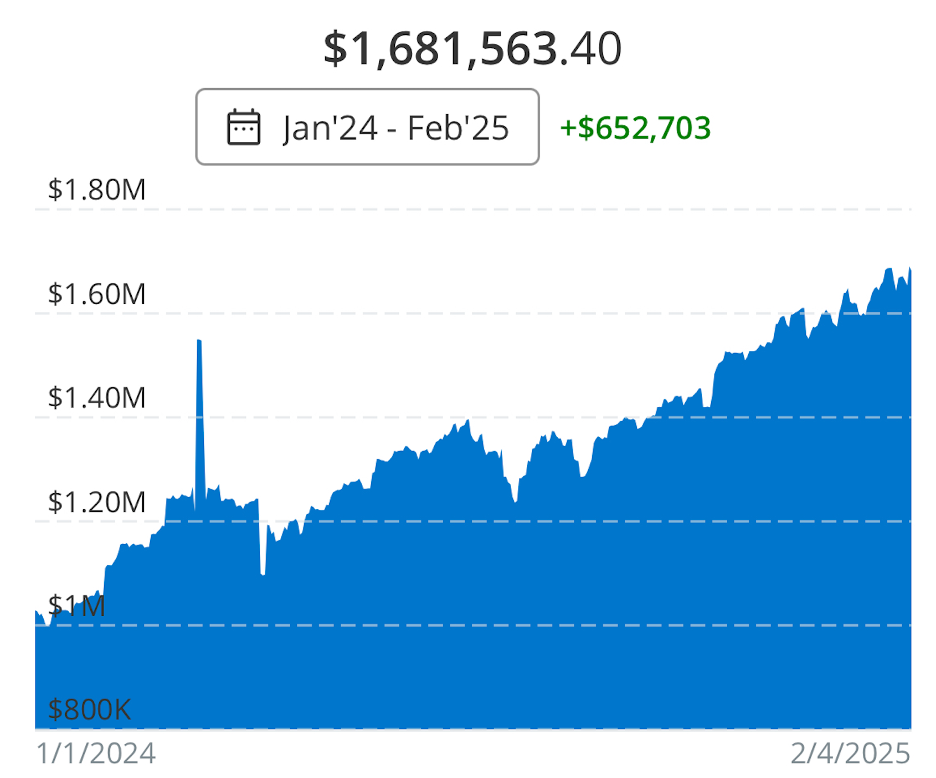

Investments

Market went up about 3% this month.

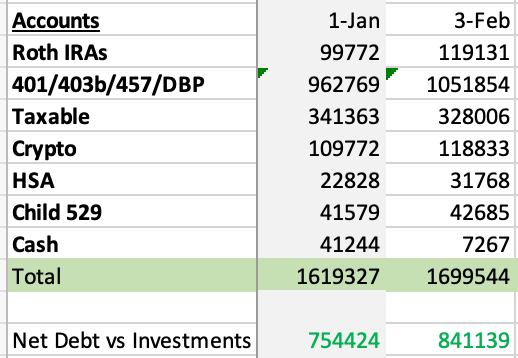

We have super funded our retirement accounts for the year. I had some left over cash from December that I deployed into our Roth IRAs (14k), HSA (8.5k) and DB plan (38k). The rest includes money from my wife’s paychecks and I added another 30k into my DB plan this month. We will continue to aggressively maximize our retirement accounts early in the year.

Investment Accounts:

Another great start to the year, up almost 90k debt vs investments. We continue to chug along.

My Financial Goals for 2024

- Hit $2 Million in investments. Currently at approximately $1.7m Need some movement in the market as we continue to aggressively fund our retirement accounts.

- Pay off remaining student loans. I start the year with ~$95k left in student loans refinanced to 1.1%. I know mathematically it makes zero sense, but I only have two years left on them regardless. I plan to fully fund my retirement accounts in the first quarter of 2025 and then have them gone by midway through the year.

- Work less? I said that last year, didn’t happen.

-AMJ