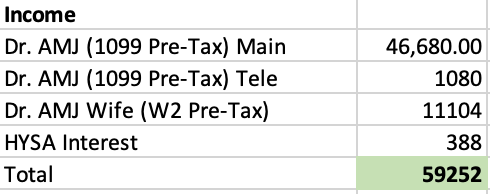

October Total Income:

We had a few small trips planned this month however they ended up getting cancelled due to weather (IE Florida hurricanes) thus we both ended up picking up a few more shifts. I also started a new telemedicine gig last month and got my first paycheck from that.

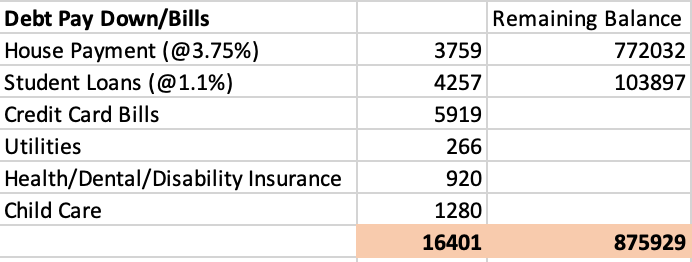

Expenses

Fairly standard month for us outside of some higher credit card bills as we spent some extra money getting ready for our son’s birthday party.

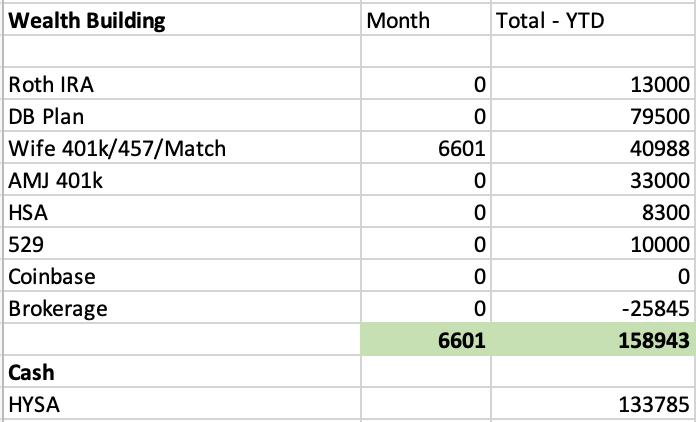

Investments

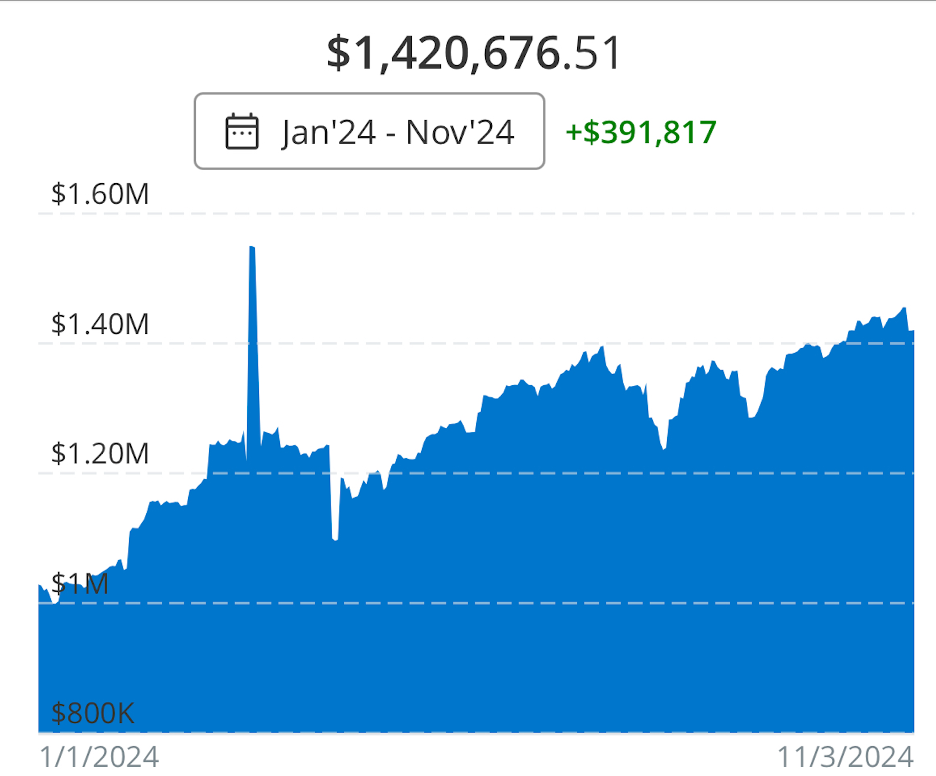

We continue our slow march upward. No complaints with the market this year!

My wife continues to work on maxing out for 457. I have a lot of cash saved up waiting to pay my S corp tax bill at end of year and waiting to see final numbers before I invest more in the market.

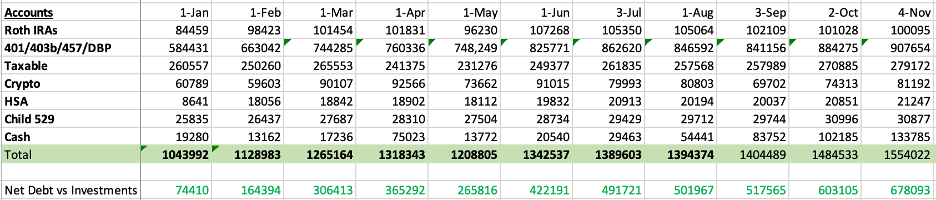

Investment Accounts:

We continue our upward trend month after month.

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- I still continue to work a lot. I’m trying

- Fully fund all retirement accounts – $168,300 GOAL – DONE

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000 DONE

- Family HSA Plan – $8,300 DONE

- AMJ and Wife 401ks – $23000 x2 – $46,000 of 46,000 funded

- AMJ 401k Profit Sharing – $10,000 of 10,000 funded

- AMJ Defined Benefit Plan – $79,500 of $79,500 DONE

- 529 Fund for son – $10,000 DONE

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed ON TRACK

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

- DONE

-AMJ