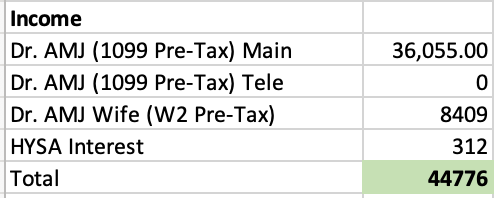

September Total Income:

My income is down a little bit this month as we took a vacation for a week thus worked a few less shifts. Otherwise nothing major to write about this month regarding income. I’m holding a lot of cash right now for my taxes and further retirement contributions so my HYSA interest is paying out decently right now.

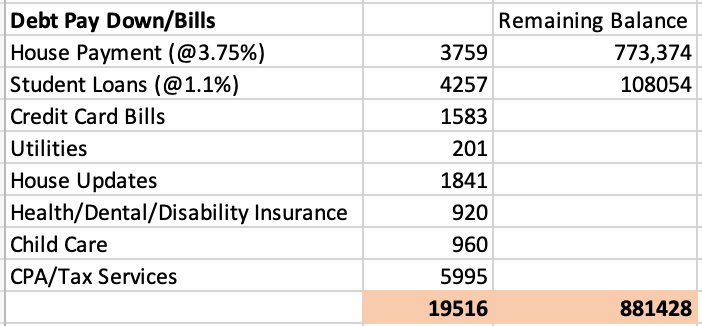

Expenses

We did some yearly house maintenance, and I had my cpa/tax service bill due so those were major extra expenses for the year.

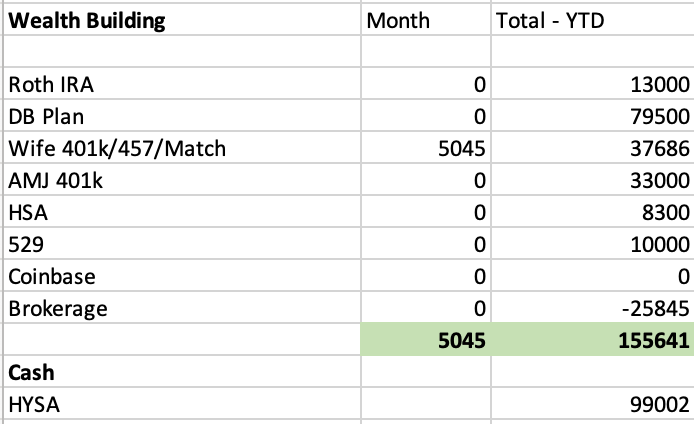

Investments

With the .50 rate cut this month, markets continue to move upward. No complaints there.

My wife continues to work on maxing out for 457. I have a lot of cash saved up waiting to pay my S corp tax bill at end of year and waiting to see final numbers before I invest more in the market.

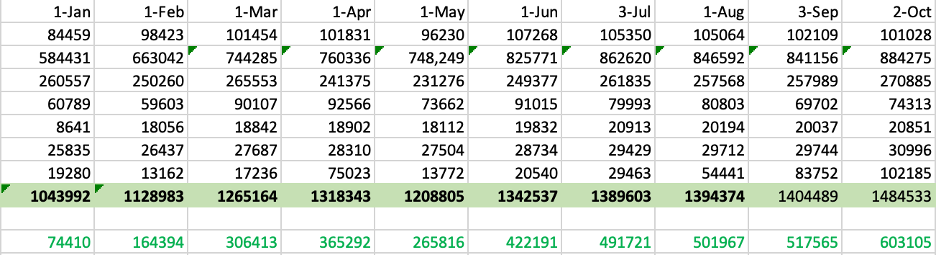

Investment Accounts:

I continue to be blown away just how fast compounding is now working in our favor. We have only made minimum payments on our low interest debts (mortgage and student loans) and invested as fast and aggressively as possible. With the market up over 20% this year, we are crushing it.

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- I still continue to work a lot. I’m trying

- Fully fund all retirement accounts – $168,300 GOAL – DONE

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000 DONE

- Family HSA Plan – $8,300 DONE

- AMJ and Wife 401ks – $23000 x2 – $46,000 of 46,000 funded

- AMJ 401k Profit Sharing – $10,000 of 10,000 funded

- AMJ Defined Benefit Plan – $79,500 of $79,500 DONE

- 529 Fund for son – $10,000 DONE

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed ON TRACK

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

- DONE

-AMJ