About me: I am a full-time emergency medicine doctor a few years out of residency (finished in 2020, currently 36 years old). I am currently working as a full time 1099 independent contractor with a few side hustles here and there. I am married to my beautiful wife, Mrs. AMJ and have one child. I created this blog to track my financial journey. My goal is to maintain a balanced approach to my finances between slowly paying down my low interest debt, investing aggressively, but also enjoying life along the way (IE: Somewhere between frugal and YOLO). Thank you for following along.

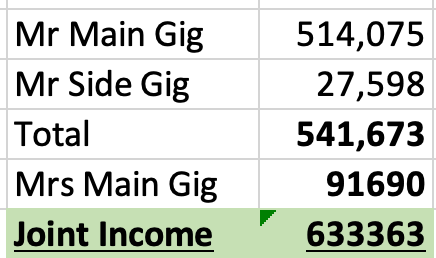

2024 Total Income

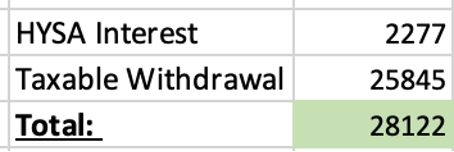

2024 Other Income/Withdrawals:

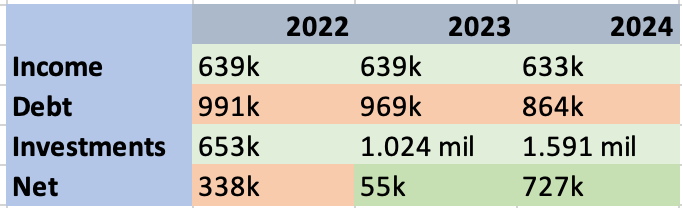

Well, one of my goals this year was to try and work less. I did not do any such thing. Still grinding out lots of shifts in the ER, working a few telemedicine side hustles here and there. My wife has also been working part time and been able to pick up some extra work from home as well. Two years ago, we made over 600k and I wondered if we would ever do that again, here we are for the third year in a row clearing 600k.

Investments:

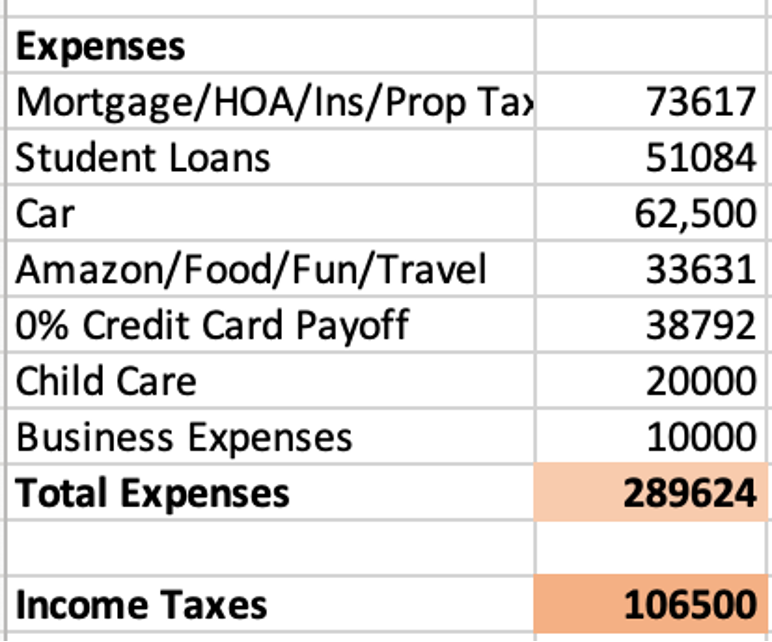

Yearly Expenses

Full disclosure, I don’t track every single dollar so some of these are general estimates besides the major expenses that I have all the receipts for.

- Thankfully, we didn’t have any major upgrades or unexpected maintenance for our house this year outside of some minor things.

- Our total mortgage costs at 3.75% about 45k/year.

- That means an additional 40% goes into HOA, taxes, maintenance, utilities, etc.

- I continued to make minimum student loan payments, they are now sub 100k and I think this year (2025) will be the payoff year.

- The major extra expense this year was buying my wife a much needed new car. We paid for it in cash, we did have to sell 26k out of our taxable account to make the cash purchase. She got her new dream car, happy wife happy life.

- Income Taxes – I filed as an S corp as I work full time as a 1099, we also are deferring >$150k in pretax accounts between my wife and myself which allows us to dramatically lower our tax bill.

- I had 38k in left over 0% credit cards from furnishing our home in 2023, I paid them all off before they began

- Child Care – my son is now in part time “school” aka day care and we had a part time nanny as well when we both work, cost was just over $20k for the year

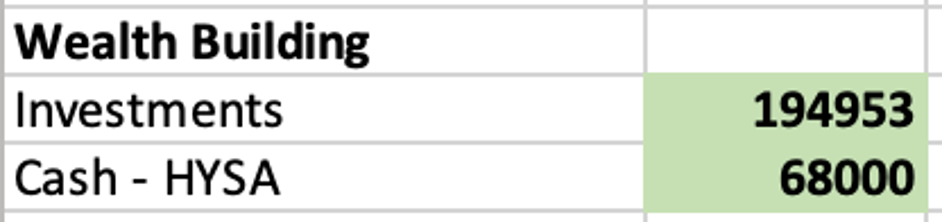

Wealth Building

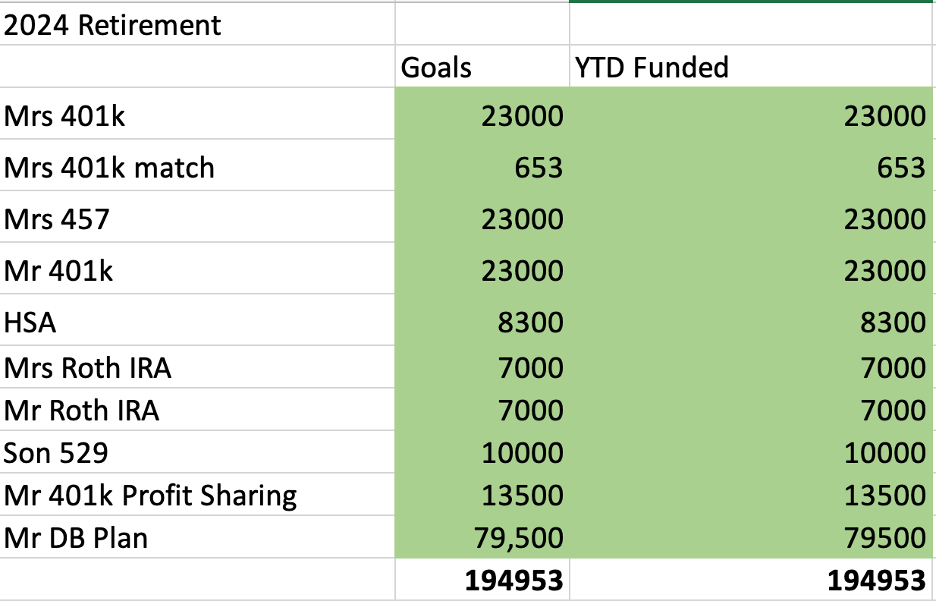

Here’s a breakdown:

- Mainstay of my retirement accounts is a combined 401k with a defined benefit plan allowing me to put a ton of money away pretax

- Wife was able to make her 401k and also max 457, she gets a small match

- I am putting away 10k a year for my sons college, plan to do this for 18 years.

- Any extra cash I saved away in HYSA, this was immediately deployed in 2025 to front load our retirement accounts.

Investment Accounts:

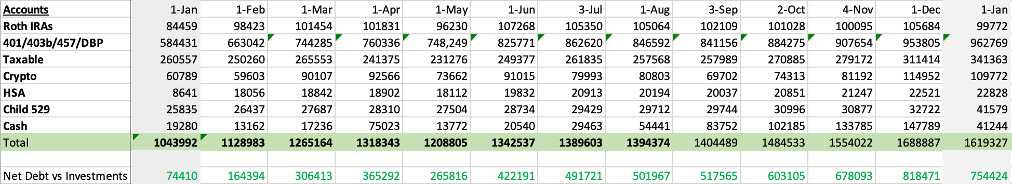

We officially hit 1 million in investments last year in December. We continued to have another insane run up in the market. I am mainly invested in US growth stocks (largest holding is VUG) which have done extremely well the last two years (but got killed in 2022).

Yearly Review:

It is fun to look back on how far we have come in the last 2-3 years. We are making way more than I anticipated I would as there continues to be unlimited work where I live (basically I can pick up any open shift I want any day). Still looking to find a balance there. I said I’d work less this year and I just haven’t. I don’t include our house in our net work (I probably should), but I find it hard to value as we have a custom built home thus I don’t know how accurate Zillow really is.

Looking ahead to 2025, I’ve recently started another telemedicine gig that is paying fairly well, almost as much as my main ER gig. I’m also starting a PRN gig with another ER group in the area, although slightly longer commute. Time will tell as I try and mold a sustainable career in emergency medicine. Especially since starting a family, night shifts have become much harder on not only myself physically, but also my wife. I have this dream of hitting 3 million in investments by 40 years old that will allow me enough financial freedom to tell wherever I’m working to drop the night shifts. I’m not there yet, but I’ve made progress.

My Financial Goals for 2025

- Hit $2 Million in investments. Currently at approximately $1.6 mil, I plan to put in at least 200k, that requires a market return of about 10% to get me to $2 mil.

- Pay off remaining student loans. I start the year with ~$95k left in student loans refinanced to 1.1%. I know mathematically it makes zero sense, but I only have two years left on them regardless. I plan to fully fund my retirement accounts in the first quarter of 2025 and then have them gone by midway through the year.

- Work less? I said that last year, didn’t happen.

Thanks for following!

-AMJ