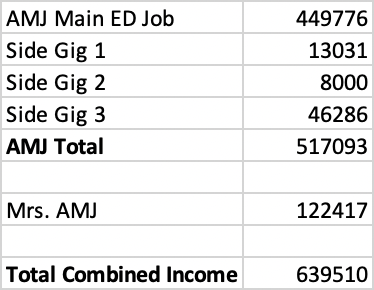

Well 2022 has come and gone. There were many highs and lows and was definitely a year of transition. We decided to sell our house, quit our jobs, move across the country, build our dream home on the water and had a son. It was definitely a great year for income and a terrible year for the stock market. Combined, my wife and I made approximately $639k. I will break down how we spent, saved and invested that money.

Disclaimer: I don’t track every dollar/budget, whatever you want to call it, some of the spending is estimated or pulled from credit card data, etc.

Income Summary for 2022:

White Coat Investor loves to say “live like a resident”. I can say this year, I definitely, “worked like a resident”, if not more. I worked several different side jobs, telemedicine, urgent care, other ED moonlighting which helped boost my income. The average ED doc makes over 350k, if you boost your shifts up 20-25%, you can easily get in the $400k+ range, especially if you find a good paying gig. My wife is taking time off to raise our son and I’m starting a new job which will definitely not be as high paying (initially) so I wonder if it will be years until we reach an income >600k again, if ever.

Summary of Expenses for 2022

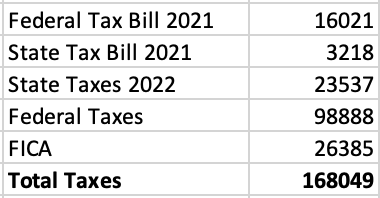

Taxes: 168k

Healthcare: 19k

Housing: 73k

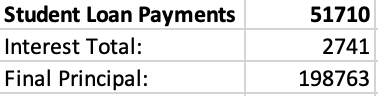

Student Loans: 52k

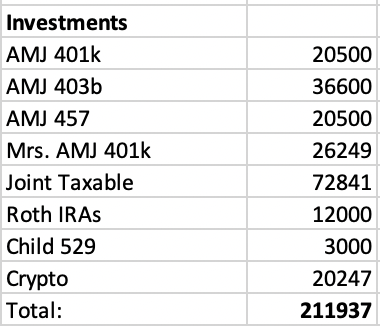

Stock Market Investments: 212k

Credit Card (amazon, food, travel, etc): 40k

Cash: ~75k

Here is a further breakdown of these numbers:

Ouch, 168k to taxes alone this year, downside of being a high earning W2 employee. We owed over 19k in underpayment taxes for 2021. We were covered by the safe harbor rule so there were no penalties but still hurts to make those big payments in April. I’ve been doing a lot of reading and learning on how to lower our tax bill, especially via real estate which I’m hoping we can dip our toes in this year. Just doing rough calculations, we will probably owe around 25k again come April 2023 but will again be covered by safe harbor rule (must pay at least 110% of your owed federal taxes from the previous year).

Next up, medical expenses:

My wife has amazing insurance through work, so our costs are minimal compared to others. We will have a high deductible/HSA insurance coverage moving forward so these expenses will be much higher this upcoming year. My mom unfortunately had a some health issues this year and needed some help with her care so I’ve included that information. I also continue to pay $184/monthly for disability insurance I bought as an intern for $5k coverage.

Student Loans

I was able to refinance my loans with Laurel Road in January and able to get my rate down to 1.1% fixed on a five year loan. The have a checking account direct deposit discount that gives me .55% discount plus autopay discount of .25% which is how I get it down to 1.1% as I use them as my primary checking account. I now owe 198k down from 281k in 2020. Four years left of ~50k/year payments and they are gone. Certainly have some regrets refinancing them right before COVID hit as I could have avoided payments for 2.5 years now and potentially gone for PSLF but I feel better with my low rate and just make those mortgage size payments every month. Additionally, my new job is not PSLF eligible so I have the freedom to not worry about being handcuffed to a certain job.

Investments

Well, this is perhaps the most depressing part of our portfolio. Why you ask? Lets tell a look at our net worth on personal capital.

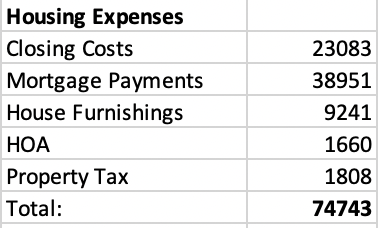

Housing Expenses

We were living (essentially for free) with my inlaws this year while we build our new home so we actually paid no personal housing expenses, which really helped us get ahead on our house. We opened a construction loan (rate locked at 3.75% in January) which cost us 23k to close (part of this went to principal). I paid down some the mortgage with some bonus payments which total nearly 39k. I just psychologically wanted to get the mortgage under 800k which I’ve done. Total principal left is currently 797k. Given that you can no longer get anything close to a 3.75% mortgage, I don’t plan to pay this down aggressively anymore, at least in the near term.

Our final expenses included approximately 40k including credit card bills, amazon, travel, food etc. We are also holding about 70k in cash as we will have several large one time payments once our house is built (furniture, construction overages, etc).

As I reflect back on the year, while my net worth/investments may not show it, I hope we have created an even stronger foundation which we can continue to build on in future years. I have a lot I want to accomplish in 2023 and look forward to it! Below are my goals for 2023, lets get to it!

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash

- Max out Roth IRA x 2 for myself and wife – $13,000

- Max 401k – $22,500

- 529 Plan – Contribute $10,000

- Taxable Account – $60,000 in contributions

- Buy Rental Home– Single Family Home

- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed