Well we have officially moved to Florida and I’ve started my new job and hoping to close on our house in the next month or so. Lots of big bills and expenses were due this month. I spent more money this month than I have in my life for sure. Thankfully many of these are one time expenses and we were able to pay them with cash saved up. I’m trying to revamp how I display my expenses and everything so trying a new format this year. Will continue to break things down in more details as the year goes on.

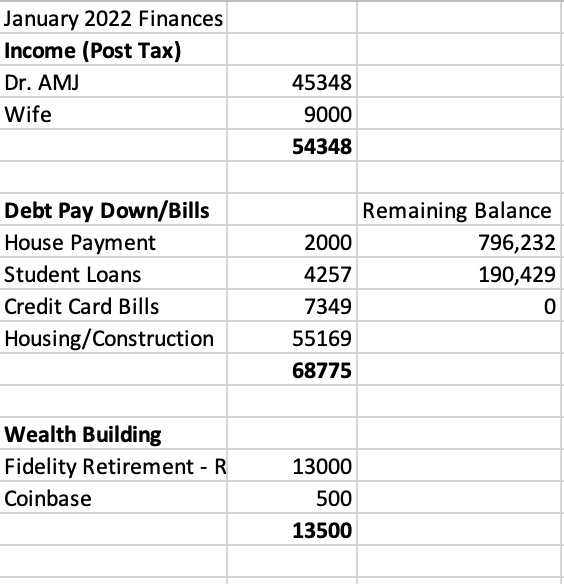

My income included a 20k moving bonus for my new job, also have been working some extra moonlighting shifts so I worked a lot bringing in some nice income this month. Unfortunately, the big final bills for our house are coming due as they finish things up which means we dished out 55k in cash. Our credit card bill was higher mostly due to moving expenses (uhaul trailer, storage unit, gas, etc). I continue to pay just a little over the minimum for our construction loan which will soon convert into a 30 year traditional mortgage. Same with student loans, slowly plugging away, less than four years to go.

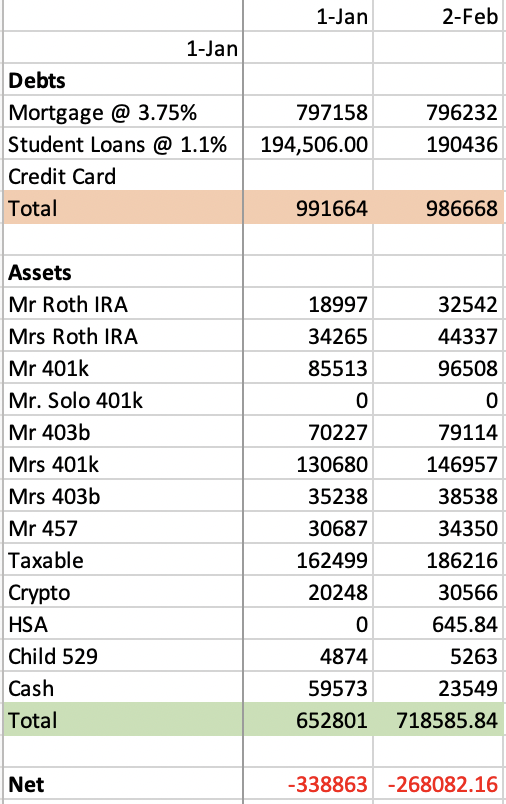

I maxed out our Roth IRAs for the year and put a little in crypto. The market was on fire in January. I’ve included the previous month to show you the difference in our investment accounts. Picture attached below.

The stock market can be fun when the numbers go up! Last year was painful after putting so much money in and watching it just drop like a rock. Our investments have finally broke $700k for the first time.

This month and next month will continue to be expensive months as we prepare to move into our house. Will need to buy appliances, furniture, etc but we are slowly picking away. Thanks for following a lot. Please let me know if you have any thoughts!

Financial Goals of 2023

- Close on our new house – Pay all final costs and furnishings with cash

- Max out Roth IRA x 2 for myself and wife – $13,000 DONE

- Max 401k – $22,500

- 529 Plan – Contribute $10,000

- Taxable Account – $60,000 in contributions

- Buy Rental Home– Single Family Home

- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed

-AMJ, MD