I left the partnership track at my job. It hurts a little bit, but honestly, it mostly feels freeing. Perhaps, long term, I would have come out ahead in the partner track and it was a huge mistake. But my job posted 1099 independent contractor positions that were paying significantly more than my current pre-partner rates.

There was significant pressure to stay on the pre-partner track from the leadership of my group, but it requires quite a bit of extra work, call days, rotating at various hospitals, some with far commutes. Additionally, with the partner track at 4 years, I realized I could have about 100k/year extra in my pocket by switching to the 1099 track. Looking at my financials, I’m realizing I may not need to work as hard as the partners do in five years. Basically, I think I can phase out from full time work in five years and this way, I get more money up front. Ultimately, the decision comes down to what is best for my family, my wife and son. And I don’t want to or need to be a workaholic Dad for the rest of my life.

So I emailed and negotiated a new 1099 contract with my current group and I made the switch and as of July 1st, I am now an independent contractor. I am still learning a lot about the 1099 position but there are several pros and cons.

Cons: No benefits (outside of malpractice). Extra Self-Employment Tax

Pros: I make overall more per hour, I can write off expenses, retirement funds (Solo 401k and defined benefit plan)

By leveraging these tax benefits, I will come out quite a bit ahead (I believe) in the short and long term. I am now 3+ years into attendinghood as an emergency medicine physician and realizing that I won’t be able to do this full time work for the long run. The circadian rhythm disruption, high pace/stressful work, unhappy patients, dysfunctional hospital system all comes crashing down on us. I do love my job, but there are aspects I want to cut out (mainly night shifts).

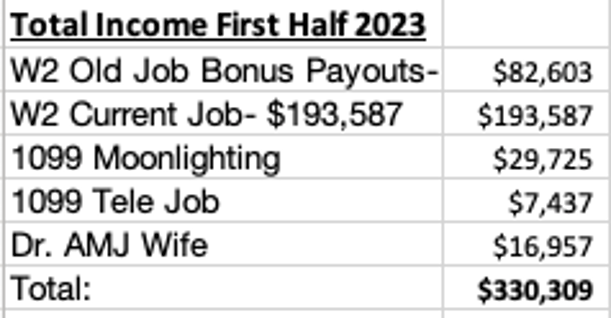

So lets see where I’m at 6 months into 2023. I made quite a bit more money than I expected as I got some large bonuses from my previous job I left at the end of last year.

Honestly, I am way ahead of where I thought I would be come halfway through 2023. I am working a bit more than I want to at this time, but I’m hoping I can eventually bring that down but the money certainly helps.

Net Worth

Our total net worth continues to rise (keep in mind I added in value of our house above in April when we moved in). thanks to the continued rise in the stock market.

Net Investments:

We continue to have a banner year for growth stocks, I hope it keeps up. Ok lets move on to the monthly breakdown.

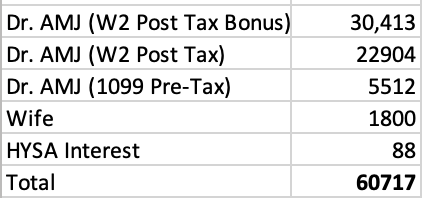

Monthly Income:

I ended up with a much larger than expected bonus from my previous job (they pay bonuses several months after each quarter ends). Now that they are coming to an end, I have to wonder when I’ll ever make $60k in a month again. I am holding on to quite a bit of it in cash as we have some house upgrades we are still planning to do and will pay in cash.

Monthly Expenses:

We continue to make minimum payments on our low interest rate debt (Student loans at 1.1% and mortgage at 3.75%). We pay off the credit cards each month (besides the one we are holding for 0 percent APR with some of the new furniture on it).

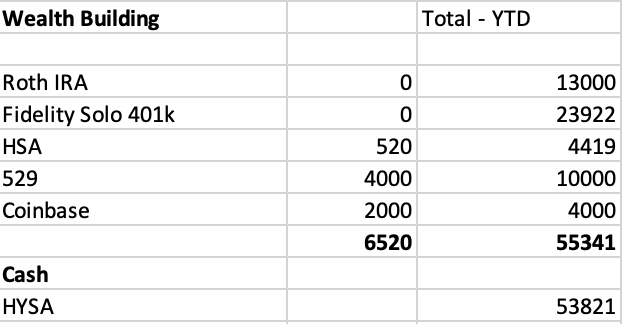

I have now put in 55k into the market and holding a quite a bit of cash in HYSA with 4.8% at Laurel Road. As stated, I have a few more large expenses as we do some additional items to our house (IE: dock and screened lanai). This year will be a year for big income but also big expenses as we moved out of state, started new jobs and moved into our dream house. I am hoping I will be able to add quite a bit more into the market in the second half of the year.

My Seven Goals for 2023 are listed below. Some of them are going to change. I really wanted to buy a rental house this year, but honestly with a new house, a newborn, multiple busy clinical jobs, its just not in the cards. I would like to try and fund my taxable account, but now that I am going to fully fund a solo 401k and defined benefit plan, I’m not sure if I will get to my 60k goal.

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash DONE (ok we are holding some on a 0 percent credit card, but only to leverage our HYSA at 4.8%)

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500 (DONE)

- 529 Plan – Contribute $10,000 (DONE)

- Taxable Account – $60,000 in contributions ($10,000 contributed)

Buy Rental Home– Single Family Home (on hold for now)- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed (ON TRACK)