Another busy month settling into our new home, the market has been on fire and have seen some serious gains this year, particularly because I am still mainly in growth stocks which got clobbered last year.

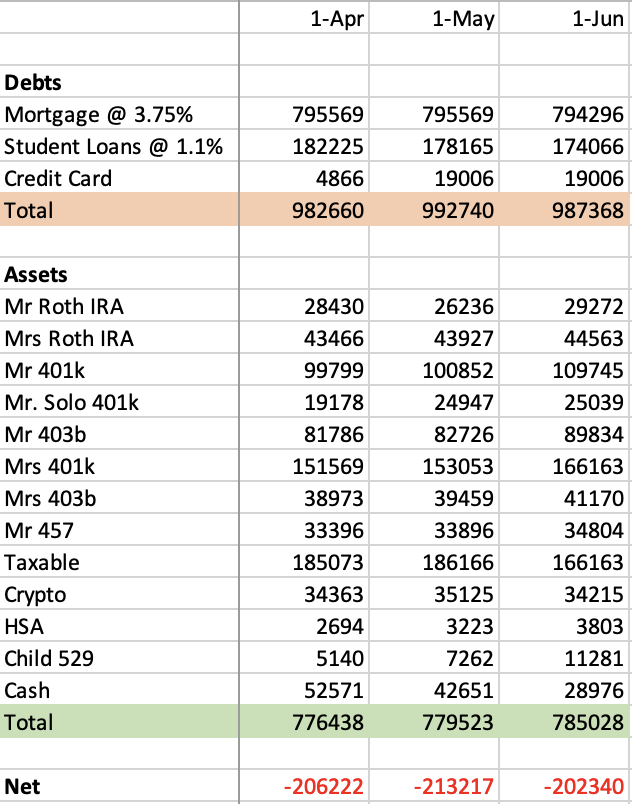

First lets look at net worth for the year. I added in my student loans, mortgage, home equity hence the major changes on my personal capital account. Hopefully from now on, it will be more stable

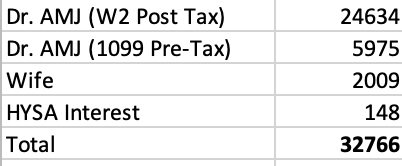

Income for the month:

Lots of extra shifts (we are short staffed like everyone else and I’m working more than I want or need to be…like everyone else). I worked a few moonlighting shifts and started another telemedicine side gig so I continue to have some decent 1099 extra income. My wife is starting to work a bit more too. I also added in our HYSA with Laurel Road as its now paying 4.8%. This now pays me almost as much as my monthly interest on my student loans (1.1%).

Outside of my standard payments for the mortgage and student loans, I’ve found keeping track of my regular daily expenses difficult just because there is so much money going in and out each month especially while we furnish the house. I’m hoping I can break this down more in the future.

No major moves with investments this month. I added $4,000 to my son’s 529 account. I have now contributed $6,000 of my goal of $10,000. I had to pay off my tax bill this month so that ate up a lot of my cash from my savings account.

As I said, May was a great month for the market. I made lots of gains in each account, Only reason it isn’t more impressive is because of tax bill eating up my cash reserves.

I’ve put about $49,000 in this year and my investment accounts are up $190,000. I hope this keeps up into the second half of the year.

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash DONE (ok we are holding some on a 0 percent credit card, but only to leverage our HYSA at 4.8%)

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500 (DONE)

- 529 Plan – Contribute $10,000 ($6,000 contributed)

- Taxable Account – $60,000 in contributions (on hold for now)

- Buy Rental Home– Single Family Home (on hold for now)

- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed (ON TRACK)