Hey all,

Another busy month worth of full clinical shifts, telemedicine and a vacation week. Emergency medicine is great because you can essentially take a vacation whenever you want. The downside is…there is no true vacation hours built in so I still end up working the same amount of shifts. With a week off, that means all my other shifts are just packed together.

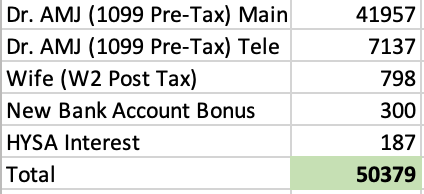

This month, I switched fully to a 1099 position. A lot went into this decision (discussed in my previous blog post) but allows me more flexibility and a few different tax advantages. Pre-tax money is obviously very different from W2 post-tax income and I’ll have to figure out a way to accurately capture this income compared to prior posts. My wife is still doing some PRN work so adds in some income as well.

Total Income:

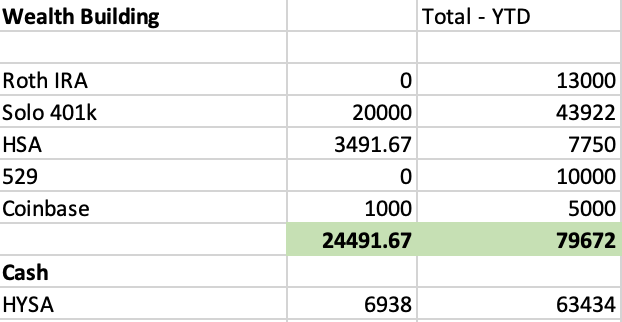

Investments:

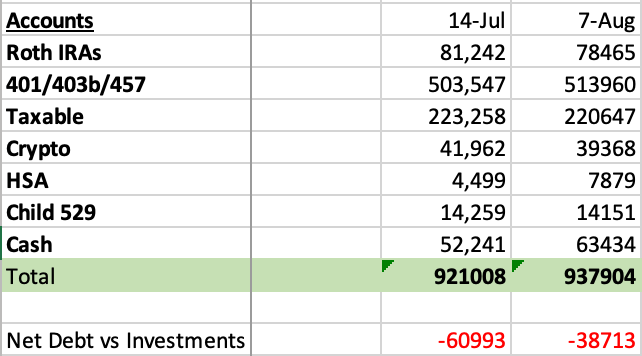

The market continues an upward tear. I have finally been able to put in a significant amount of investments this month (about 25k) plus 7k saving into my HYSA. I opened up a defined benefit plan to tax shelter more pre-tax income. I am hoping between my solo 401 and DB plan to have nearly 150k put away pretax. Will this year but the year we hit 1 million? Time will tell!

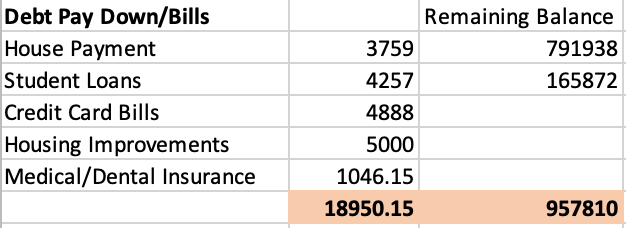

I continue to make minimum payments on my mortgage and student loans. Slow and steady. We have had to make some house upgrades as is required when you move into a new house, still have a few major things to finish up, but will be glad when those bills disappear for good.

Overall we are continuing to make a lot of progress on our accounts.

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash DONE (ok we are holding some on a 0 percent credit card, but only to leverage our HYSA at 4.8%)

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500 (DONE)

- 529 Plan – Contribute $10,000 (DONE)

- Taxable Account – $60,000 in contributions ($10,000 contributed) –> change in this plan as I have now opened up a DB plan

Buy Rental Home– Single Family Home (on hold for now)- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed (ON TRACK)

We are on track for most of our goals. I decided with a new child and my clinical work, I just don’t have time to get in the rental business this year. I have also opened up a defined benefit plan through my 1099 so most of the money that would have gone in the taxable account will now go in the DB plan instead. (DB plan is similar to a 401k, money goes in pretax and is designed to be a pension, you can also eventually roll this over into a 401k if you close the plan).

Thanks for following with my post this month. More to come!

-AMJ