Hey all,

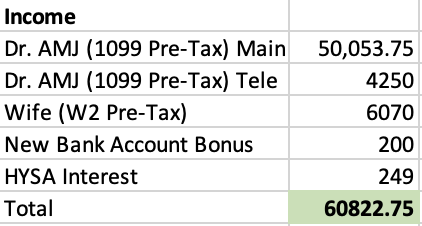

We had another good month in August, my wife officially started her new job at the local hospital working some PRN shifts. We decided to put essentially her entire paycheck into her 401k account to get it maxed out by the end of the year as we don’t really need the extra income right now. I had another busy month of clinical work and telemedicine. I also got a small production bonus from my job from the last quarter, this will be my last bonus as I am now full time 1099 which has really upped my income as you can see. Keep in mind, I am now paying for my own health insurance, life insurance, disability, etc.

Total Income:

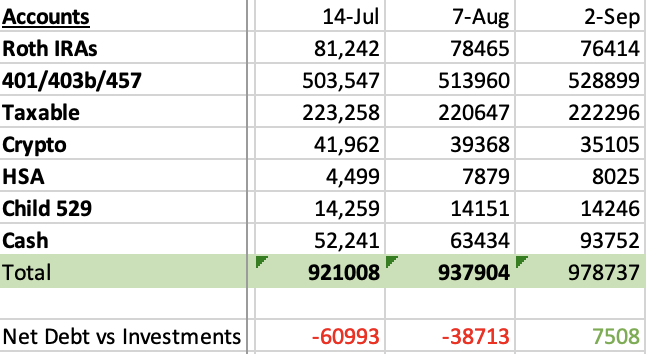

Investments:

The market didn’t do a whole lot this month, but with our additional contributions, we continue on the trend up and to the right. I plan to make some bigger contributions to a defined benefit plan which I am still getting set up.

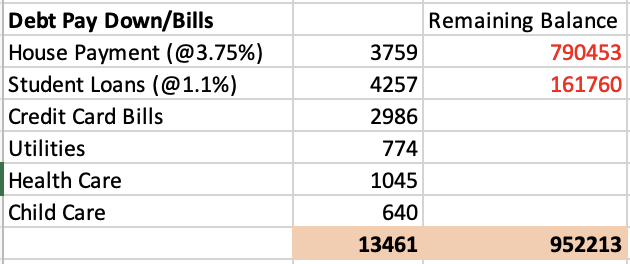

I’m trying to get a more accurate picture of our month to month expenses, adding in our monthly utility bills (HOA, electric, security, internet). I also added in our medical/dentist costs and cost of monthly child care (we hired a part time nanny for when we are both working).

Investment Accounts:

I am holding on to a ton of cash right now ($93,000+) as I have a few large dream purchases I’m planning over the next few months. IE: A dock installation and a new boat. I know most financial bloggers are all about frugality but I’m hoping to take a more balanced approach. This dock and boat is a dream of mine and I’m going for it.

My income also is much higher than I expected as I am making more money as a 1099 and had additional work bonuses I didn’t expect. We are on track to make over $600k this year alone. Obviously, the traditional advice is to wipe out all the student loan debt, but at 1.1% interest rate, I don’t see the point right now. I’m an emergency medicine doctor, life is short, I watch people die at work every day. I’m still on track to wipe out my student loans in three years with 161k left while aggressively investing.

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash DONE (ok we are holding some on a 0 percent credit card, but only to leverage our HYSA at 4.8%)

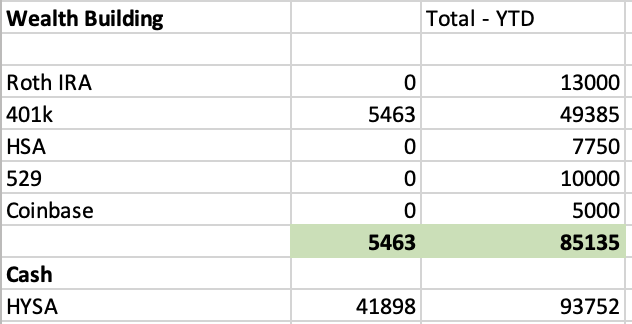

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500 (DONE)

- 529 Plan – Contribute $10,000 (DONE)

- Taxable Account – $60,000 in contributions ($10,000 contributed)

- change in this plan as I have now opened up a DB plan

Buy Rental Home– Single Family Home (on hold for now)- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed (ON TRACK)

-AMJ