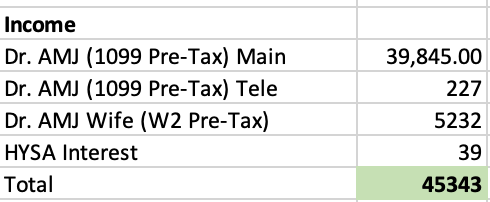

April Total Income:

This month I finally kicked back on hours a little bit. I really did minimal telemedicine work as well. The weather is nice and I’m enjoying more of my time off! We did end up purchasing my wife a new car at the beginning of the month. We sold about $26,000 in our brokerage account and then funded the rest with our emergency fund/cash, thus we have a brand new paid off car. Hurts to write the check, but it was time.

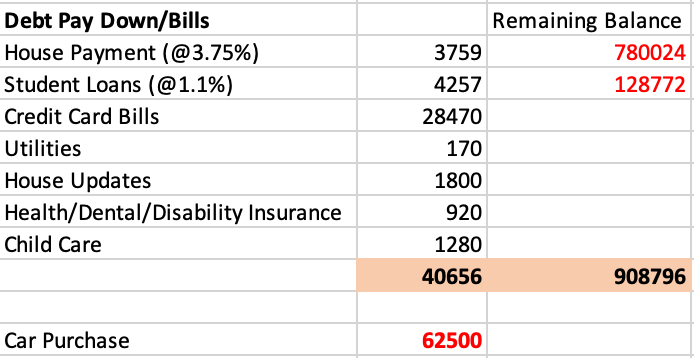

Expenses

A lot of expenses/debt paid off this month. We had a 0% APR credit card coming due and I wanted to get that out of the way as well as home insurance bill, car expenses, etc. I now have just about $19,000 left on a 0% APR credit card that I will pay off by the end of the year. Most of these were related to moving into our home, furniture, upgrades etc.

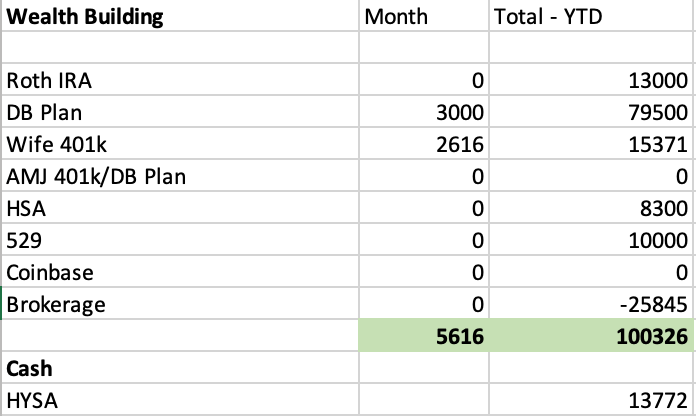

Investments

This April the market dropped, we continue to make our monthly contributions. Mostly flat to down on the month.

As stated above, we paid for our car purchase in cash and paid down a lot of debt this month so only minimal contributions, next month I will be able to make some larger contributions and start maxing my 401k.

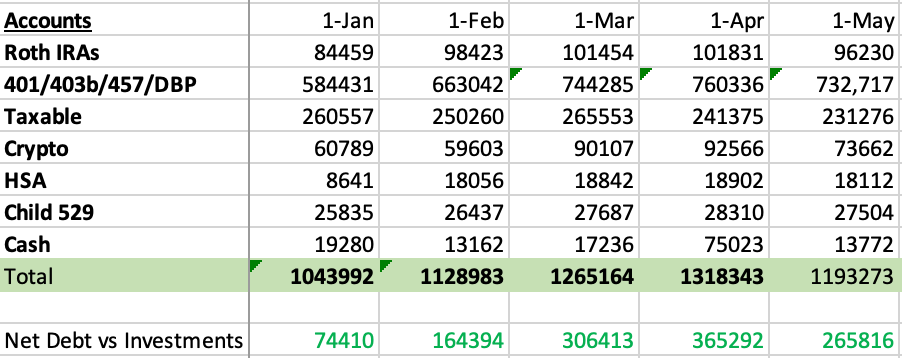

Investment Accounts:

A 100k dip this month with our car purchase and drop in the market. Hopefully temporary as I ramp up my retirement accounts through the rest of the year.

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- This month was the first month of me pulling back a bit, I am much happier with this move.

- Fully fund all retirement accounts – $168,300 GOAL – 100,326 currently funded

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000 DONE

- Family HSA Plan – $8,300 DONE

- AMJ and Wife 401ks – $23000 x2 – $15371 of 46,000 funded

- AMJ 401k Profit Sharing – $0 of 10,000 funded

- AMJ Defined Benefit Plan – $79,500 of $79,500 DONE

- 529 Fund for son – $10,000 DONE

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed ON TRACK

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

- Approximately 19,000 remaining

-AMJ