May 2024 Update

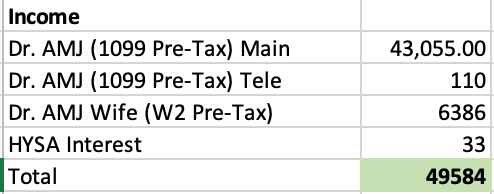

May Total Income:

Another busy month of work but still found a lot of family time and a staycation week with friends.

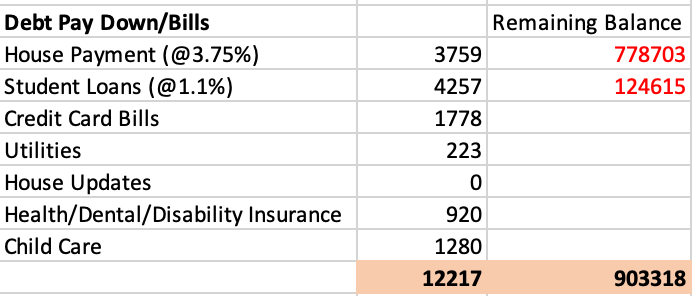

Expenses

A pretty typical month for us when we don’t spend anything extra on vacation, home improvements, etc.

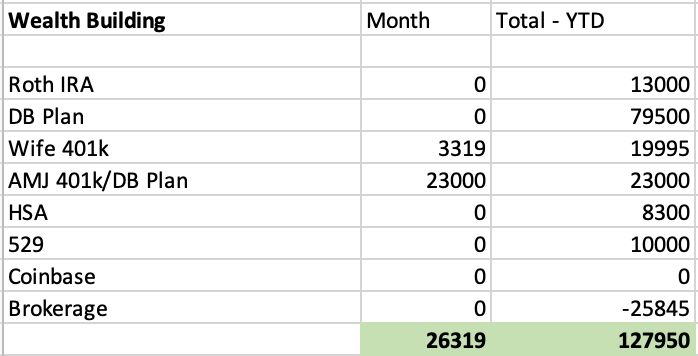

Investments

The SP500 gained about 5% in May, the market gains continue to blow my mind. The first million really is the hardest.

I maxed my 401k employee contribution this month with a $23k contribution. My wife continues to make her monthly contributions with her part time W2 gig. Her account will be maxed within the next 1-2 months.

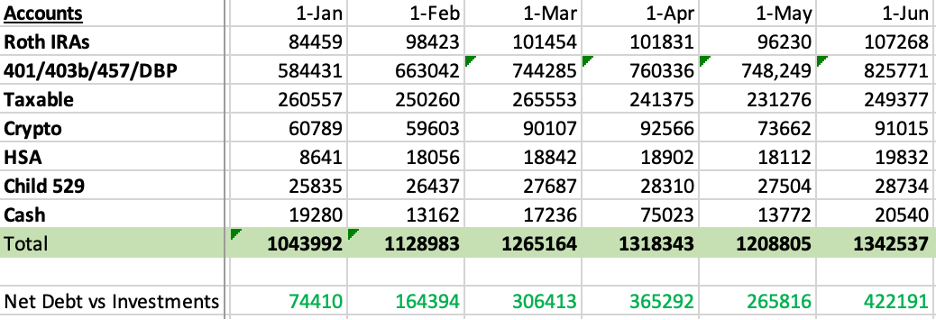

Investment Accounts:

Wow, what a month of gains. This all feels like a huge bubble. I mainly invest in growth index funds (VUG is by far my largest holding), which is up nearly 20% YTD now. If I continue to have decent gains like this, I really am only a few years away from FI.

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- I still continue to work a lot. I’m trying.

- Fully fund all retirement accounts – $168,300 GOAL –154,705 currently funded

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000 DONE

- Family HSA Plan – $8,300 DONE

- AMJ and Wife 401ks – $23000 x2 – $42995 of 46,000 funded

- AMJ 401k Profit Sharing – $0 of 10,000 funded

- AMJ Defined Benefit Plan – $79,500 of $79,500 DONE

- 529 Fund for son – $10,000 DONE

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed ON TRACK

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

- Approximately 16,000 remaining

-AMJ