March 2024 Update

About me: I am a full-time emergency medicine doctor a few years out of residency. I am currently working as a full time 1099 independent contractor with a few side hustles here and there. I am married to my beautiful wife, Mrs. AMJ and have one child. I created this blog to track my financial journey. My goal is to maintain a balanced approach to my finances between slowly paying down my low interest debt, investing aggressively, but also enjoying life along the way (IE: Somewhere between frugal and YOLO). Thank you for following along.

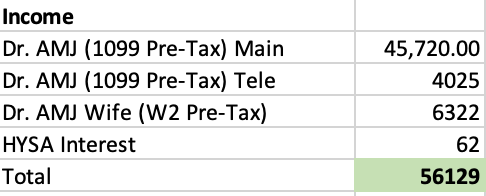

March Total Income:

Another busy month of shifts, I was supposed to work less this month, however due to some family emergencies, I had to move around some shifts and ended up working quite a bit more than originally scheduled. My telemedicine gig did officially end its contract so this will be my last month of that extra side gig income. I have been dabbling in some urgent care telemedicine work, but its honestly been pretty slow and I haven’t had a whole lot of free time to do it.

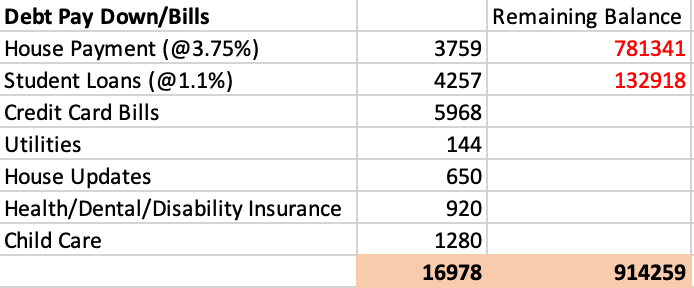

Expenses

Fairly standard month, we did some minor home upgrades and will have some more coming in the next month or so, this lead to a big larger credit card bill this month. We will also have to pay our home insurance this month which is now over $3,000/year.

Investments

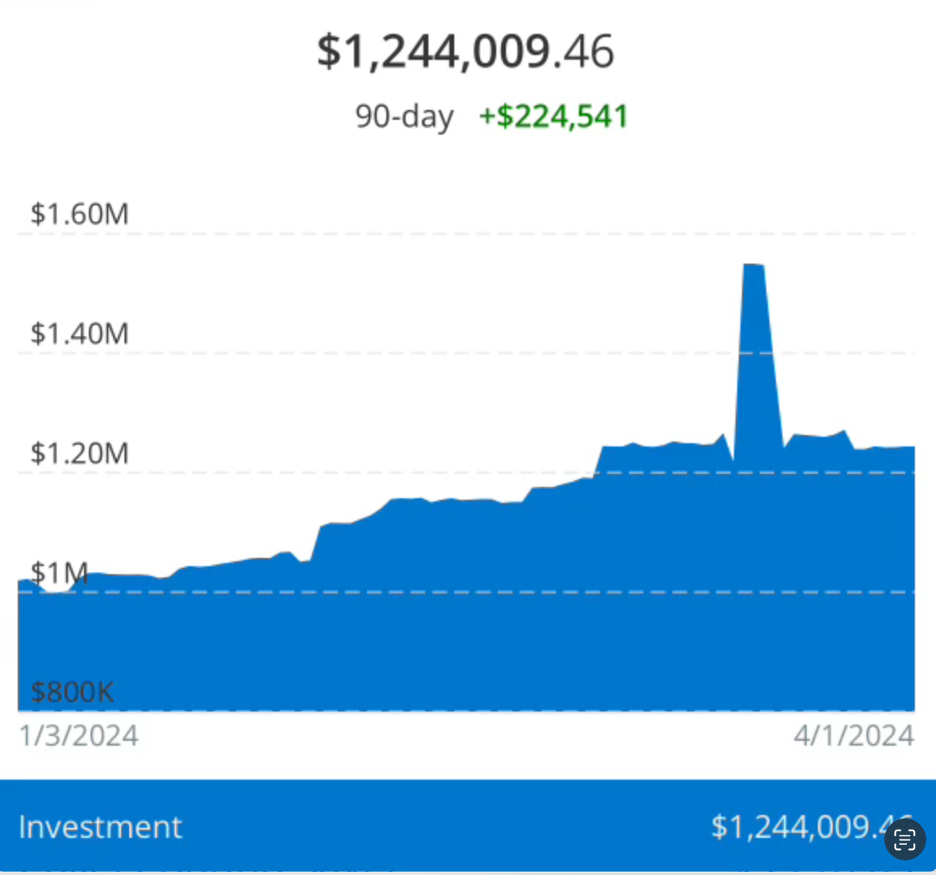

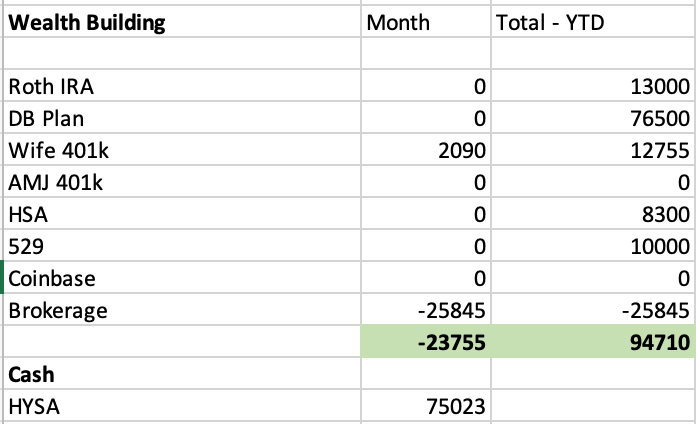

The middle finger on the chart is related to me moving my accounts from my 401k into a brokeragelink on Fidelity, which briefly double counted the money during transfer, otherwise ignore that portion. I have a few ETFs that I prefer over the available mutual funds in our work related 401ks. The big news is us withdrawing about $26,000 from our brokerage account to fund a new car for my wife, hopefully we will be able to purchase this month. Her car is on its last leg and after taking it to the mechanic and realizing we likely have another large pending bill, we pulled out some money to have cash available for a car purchase. With that money pulled out, we were essentially even in our investments for the month. I should be able to replenish this later this year.

My DB plan/401k plans are now funded in time for my tax return for 2023. I am holding a ton of cash right now as discussed above for our pending card purchase.

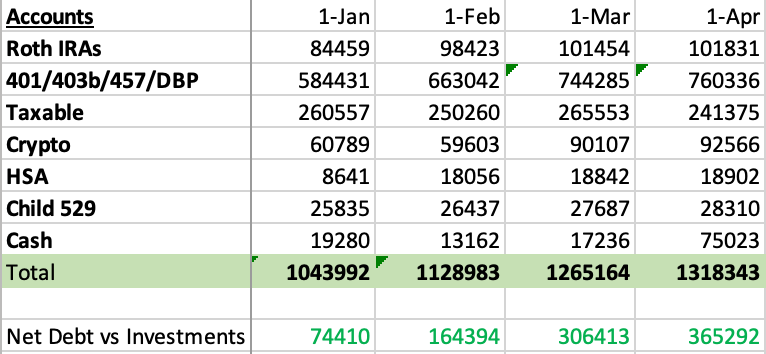

Investment Accounts:

Just a slow continued upward trend here. Once we make our car purchase, this will create a little dent, but hopefully just temporary.

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- With my telemedicine gig ending, I am working a bit less just from that, I am now scheduled for fewer clinical shifts moving forward.

- Fully fund all retirement accounts – $168,300

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000 DONE

- Family HSA Plan – $8,300 DONE

- AMJ and Wife 401ks – $23000 x2 – $12755 of 46,000 funded

- AMJ 401k Profit Sharing – $0 of 10,000 funded

- AMJ Defined Benefit Plan – $76,500 of $76,500 DONE

- 529 Fund for son – $10,000 DONE

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed ON TRACK

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

-AMJ