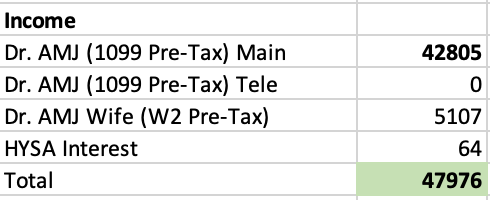

June Total Income:

Full month of shifts, this is my first month this year without any side gig telemedicine payouts, I have just been honestly too busy at home with my time off. Definitely plan to get back into it later this year but for now just working my shifts and coming home. My wife will also start working a bit more this upcoming month (sorta forced to by her job) which will help increase our income a bit.

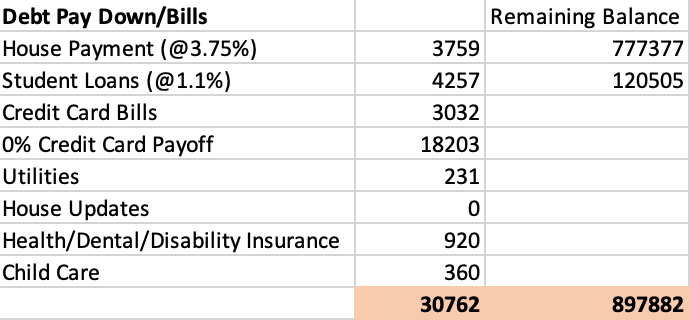

Expenses

I decided to payoff our 0% credit card bill a few months early, which we had been dragging out. This makes over $38k of cc debt we had been carrying since last year to cover some of our moving/housing/furniture etc expenses. Otherwise our expenses are pretty standard.

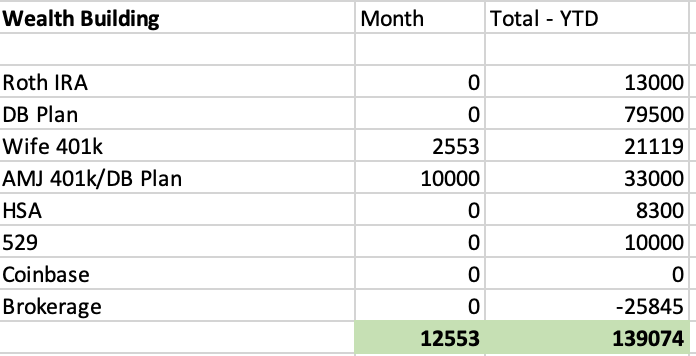

Investments

Markets continue to trend up. I am mainly invested in growth index stock funds/ETFs which have just been on a tear. It feels like a correction is coming but we will stay the course. 1.4 million is in sight, which just blows my mind.

My wife is now nearly maxed out on her 401k this year. We have more than enough cash flow that she is going to also fund her 457 at work and hopefully can max it by the end of the year or at least get close. I made a 10k contribution to my 401k profit sharing portion. I’ve now hit my personal investment goals. I would like to re-fund my brokerage account with the money we had to take out earlier this year for a car purchase, but for the next few months will be saving up for my S corp tax payment at the end of the year.

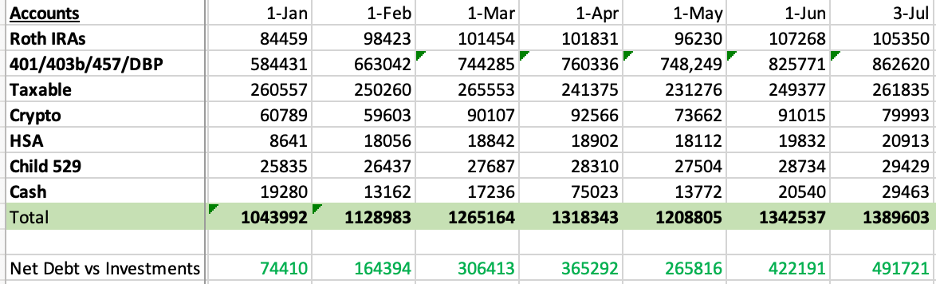

Investment Accounts:

We continue to make huge progress month by month.

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- I still continue to work a lot. I’m trying

- Fully fund all retirement accounts – $168,300 GOAL – 164,919 currently funded

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000 DONE

- Family HSA Plan – $8,300 DONE

- AMJ and Wife 401ks – $23000 x2 – $44,119 of 46,000 funded

- AMJ 401k Profit Sharing – $10,000 of 10,000 funded

- AMJ Defined Benefit Plan – $79,500 of $79,500 DONE

- 529 Fund for son – $10,000 DONE

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed ON TRACK

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

- DONE

-AMJ