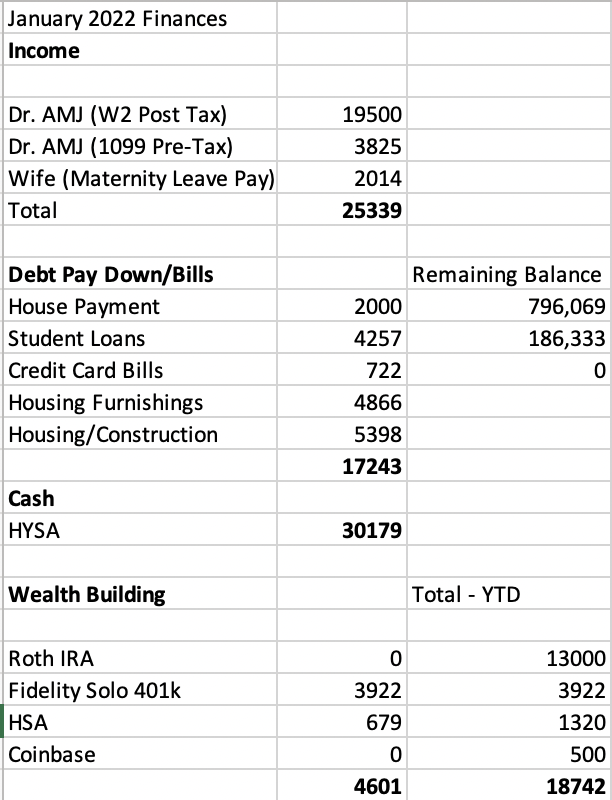

February was another busy month of work but overall everything is going well. I’m having trouble keeping a simple budget as we continue to have several large one time expenses as we plan to move into our house something this month (March 2023!). I finally bought H+R Block and plugged in my taxes and oh man what a tax bill. I owe about 27k in federal taxes and about 7k in state taxes (grateful to be in Florida for this year as we owe 30k in 2022 state income taxes). We should be able to pay this off in April no problem but need to keep up my cash buffer. My wife also opened a new credit card with zero percent APR for 18 months to put some of the house furnishings on. We could technically just pay it off but going to run a little bit of CC debt interest free to give us some more wiggle room. Here’s a look at our monthly spending:

This marks the end of maternity leave pay for my wife, but she is planning to go back to work this month for some PRN stuff but still raise our son full time. I’ve been learning how to do a solo 401k for the first time, I made some contributions for the 1099 income I earned for last year and have started fund my employee contributions for 2023 (My new W2 full time job doesn’t let you open a 401k until you have been with them for an entire year).

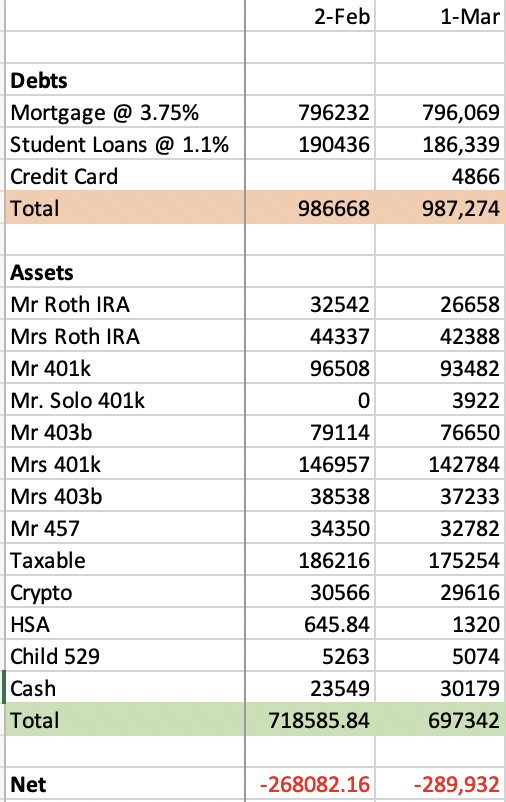

No way around it, it was a bad month for the market and saw our net worth drop about 20k despite adding to our retirement accounts and slowly paying down our debt. I have also begun thinking about how I will include our house in our net worth which I haven’t been doing. We have a 800k mortgage but the value of the house is somewhere around 1.3-1.5 million based on comps in the area, although I know the market is starting to drop. Since we have done a custom build, I can’t just look at zillow and use their numbers either.

Hoping March will bring us some good returns in the market!

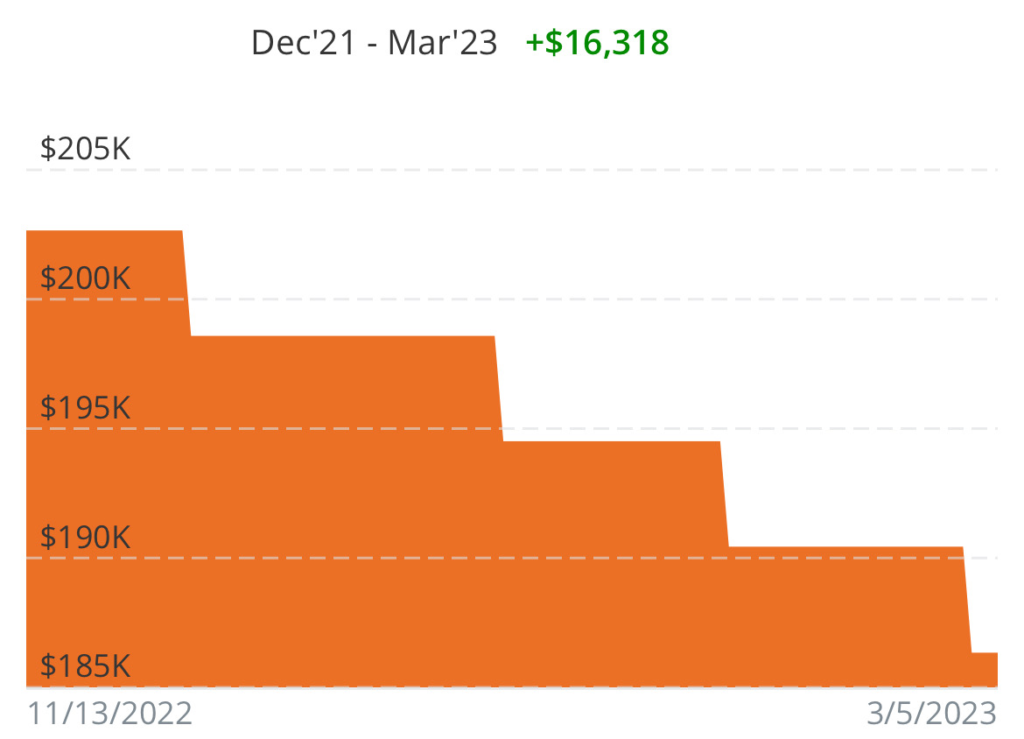

Student loan debt continues a slow march down, each month making payments of $4257, @1.1 percent interest, I’m not paying this a day sooner.

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash (hopefully this March!)

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500

- 529 Plan – Contribute $10,000

- Taxable Account – $60,000 in contributions

- Buy Rental Home– Single Family Home

- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed

March will bring in lots of changes for my family, hoping finally moving into our dream house and settling into our new life in Florida. The first few months of transition in Florida have been challenging, lots of work, but I am looking forward to the future