Hey all, another busy month of work, involved 20 busy shifts in the emergency department as well almost a full week of vacation as my family was visiting. A major downside of shift work/emergency medicine is you don’t really get vacation. We are contracted for the same number of shifts each month, a vacation week just means you pack your shifts around it and there aren’t many days off when the vacation is over. I definitely need a find a better balance in the future. In fact, I’m writing this wide awake at 1am in the morning as I am unable to sleep after coming off some night shifts.

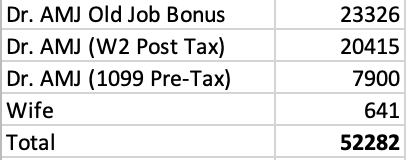

The good news about all this work is I have had some nice paychecks. I actually didn’t realize I was going to get a remaining bonus from my old job, but I did for ($35,000!!!, ~$23,000 after tax). This was an awesome surprise to show up in my bank account as I owe about $25k in federal/state income taxes in April. We also are paying the last “big bill” to finish our house totaling about $8500 for some landscaping.

My wife started a new PRN job so she is bringing in a little bit of cash (and I’m getting to watch our son all day instead of working all day!). I got a surprise bonus from my old job (they pay out 3 and 6 months after the quarter ends, I knew I’d get something but didn’t think it would be that much). I made 20k from my main gig and 7900 from my moonlighting gig. That said, it was a mega month to bring in some cash. Lots of expenses to cover however as 25k of it will be going out to taxes in April 🙁

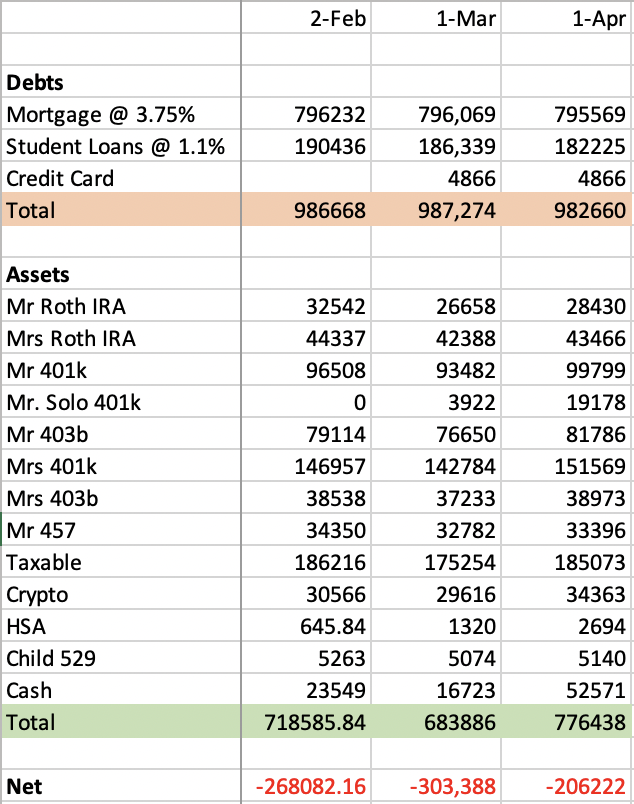

We are continuing to slowly pay down the mortgage and student loans. I’m hoarding a bunch of cash to pay the taxes and other bills as we are now supposed to close some time in April on our home (finally!).

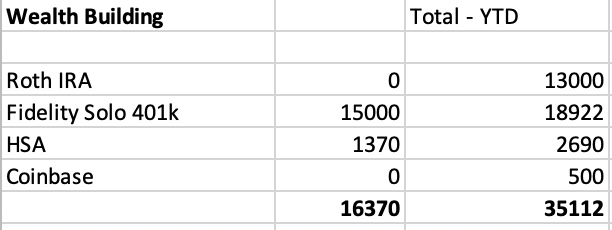

I decided to put in 15k into my 401k this month given the extra bonus money and received my employer contribution to my HSA so had a bigger contribution.

March was a great month for the stock market, crazy to see my net worth change by almost 100k in one month (52k in income alone certainly helps). This is the first time that my taxable account ($185k) exceeds my student loans ($182k). Which means with a few clicks, I could wipe them all out. It is tempting but remembering slow and steady wins the race. Will continue to slowly pay them down month by month although I think in the last year or so, I will just dump them so I can drop the payments.

Investments are hitting record highs this year. I hope it keeps up…still hearing all the bears on twitter and CNBC saying the big crash in imminent. Just keep buying I keep telling myself.

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash (Ok for real will happen in April!!!!)

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500 ($16,898 contributed)

- 529 Plan – Contribute $10,000

- Taxable Account – $60,000 in contributions

- Buy Rental Home– Single Family Home

- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed (ON TRACK)