We are finally in our new house!!! After several months of delay, we finally moved into our dream home. We have spent a lot of time unpacking, setting up as well as a spending a lot of money furnishing it. It is honestly a bit difficult for me to keep track as so much money has been coming in and going out at the same time, including $26k tax bill this month. I’m doing my best to keep everything as accurate as possible but a lot of this data is slightly off this month.

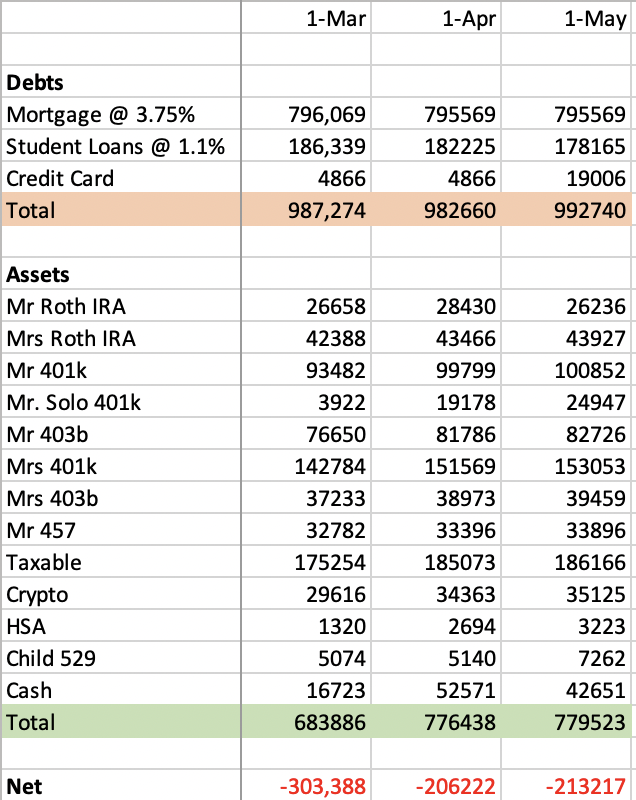

I decided to add in my house into my net worth as well as my mortgage. Conservatively, I’m valuing the house at around 1.3 million although houses in our neighborhood are now going for $1.5-2 million range. We have a mortgage at 795k. Using these calculations, we are millionaires. When I graduated residency less than three years prior, I had less than $100k in investments.

Three major things helped:

1. I married well to a frugal hardworking spouse. She bought a house while in residency that we sold for a large profit to build our current house.

2. Lived with in-laws rent free for 1.5 years while we built our house. This allowed us to save, invest and build our house and gave us a lot of flexibility

3. I worked like a dog out of residency. I picked up as many shifts as I could, moonlighted when I could, did telemedicine side gigs, etc. This boosted our income big time.

Ok lets break down this month.

A busy month of shifts packed into three weeks as we went on vacation at the end of the month.

Expenses:

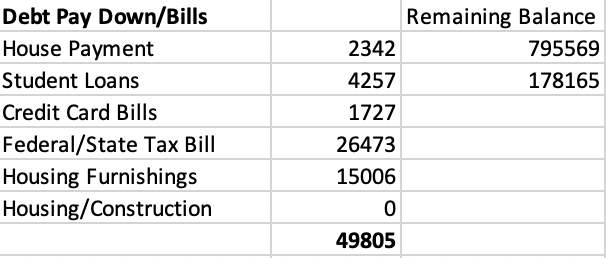

Ouch, painful to think I dropped 50k in expenses this month. But with big tax bill and moving expenses that’s the reality.

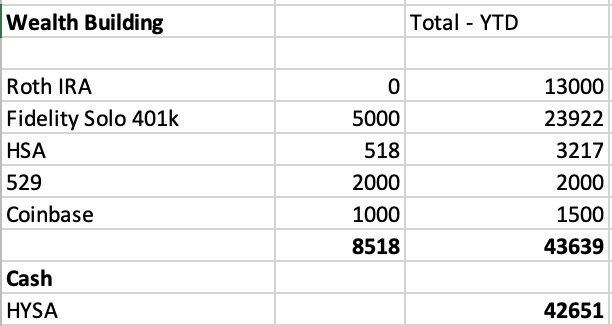

I continue to keep a cash reserve, especially now that my savings account with Laurel Road is paying 4.8%. I will slowly shrink this over time. My solo 401k employee contributions are maxed for the year, I added money to my son’s 529 and slowly buying a little more bitcoin in coinbase.

The stock market continues to trend upward. I’ve continued to invest monthly. My wife and I have a 20 month 0 percent APR credit card that we are leveraging, basically we put any house furnishings on it and have maxed it out. I’ll keep the cash in my HYSA for the next year and continue make some interest off of it.

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash DONE (ok we are holding some on a 0 percent credit card, but only to leverage our HYSA at 4.8%)

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500 (DONE)

- 529 Plan – Contribute $10,000 ($2,000 contributed)

- Taxable Account – $60,000 in contributions (on hold for now)

- Buy Rental Home– Single Family Home (on hold for now)

- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed (ON TRACK)