About me: I am a full-time emergency medicine doctor a few years out of residency. I am currently working as a full time 1099 independent contractor with a few side hustles here and there. I am married to my beautiful wife, Mrs. AMJ and have one child. I created this blog to track my financial journey. My goal is to maintain a balanced approach to my finances between slowly paying down my low interest debt, investing aggressively, but also enjoying life along the way (IE: Somewhere between frugal and YOLO). Thank you for following along.

Hey all,

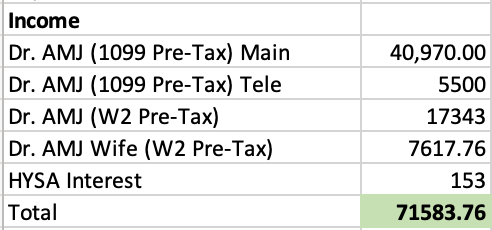

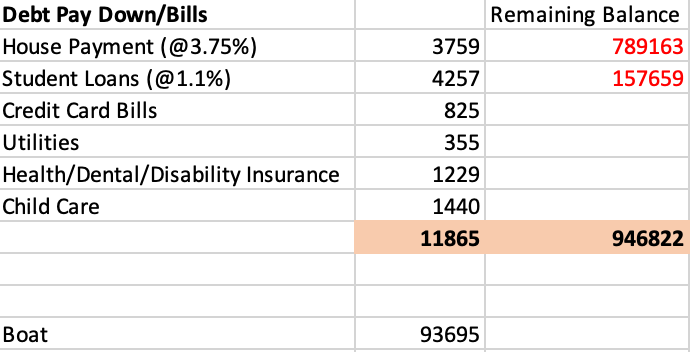

I bought a brand-new boat. It cost over 93k. I paid cash for it. Maybe a huge financial mistake/set back but life is short and this is what I love to do. We also moved to Florida and live on a canal so it is a dream for us to walk outside from our home and be on the water. My wife has returned to part time work which is helping us increase our income. I also received some delayed bonus payouts from my previous job totaling 17k which is a super nice boost. Income break down in below.

Total Income:

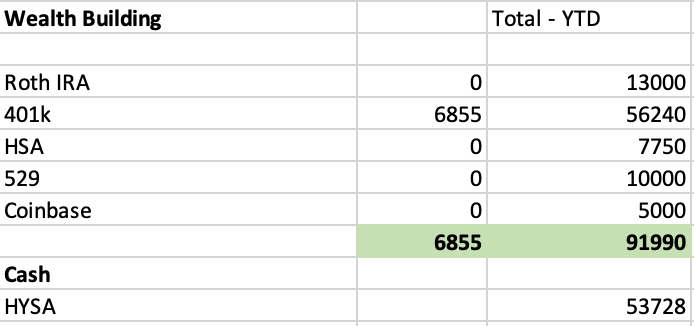

Investments:

The market continued a downtrend this past month, but we still remain dramatically positive for the year.

Outside of the boat purchase, it was a pretty good month for us income wise!

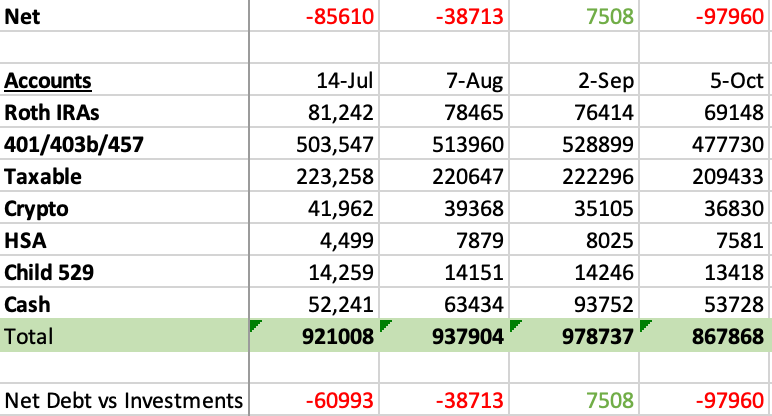

Investment Accounts:

Ouch, tough month as the boat purchase and drop in stock market has made a swing of approximately negative 100k. I’m hopeful the next few months and next year, things will improve, I am going to start contributing to my defined benefit plan next month so a drop in the market won’t be the end of the world.

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash DONE (ok we are holding some on a 0 percent credit card, but only to leverage our HYSA at 5%)

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500 (DONE)

- 529 Plan – Contribute $10,000 (DONE)

- Taxable Account – $60,000 in contributions ($10,000 contributed)

- change in this plan as I have now opened up a DB plan

Buy Rental Home– Single Family Home (on hold for now)- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed (ON TRACK)

-AMJ