About me: I am a full-time emergency medicine doctor a few years out of residency. I am currently working as a full time 1099 independent contractor with a few side hustles here and there. I am married to my beautiful wife, Mrs. AMJ and have one child. I created this blog to track my financial journey. My goal is to maintain a balanced approach to my finances between slowly paying down my low interest debt, investing aggressively, but also enjoying life along the way (IE: Somewhere between frugal and YOLO). Thank you for following along.

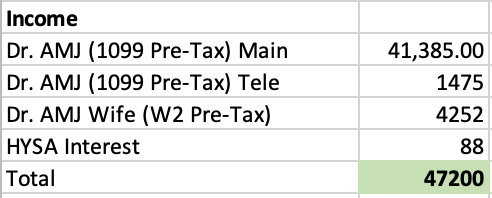

Total Income:

A busy month of shifts, no extra bonuses or extra shifts this month so around what my typical month should look like if I don’t do anything above and beyond.

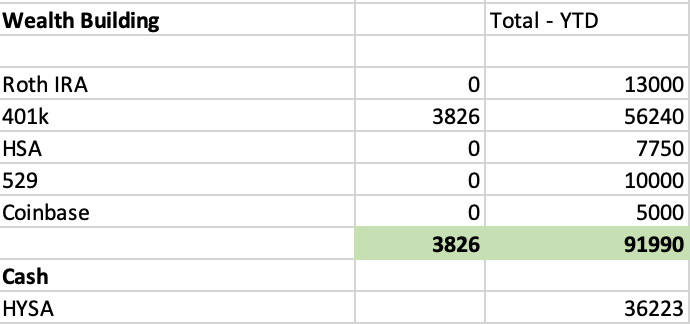

Investments:

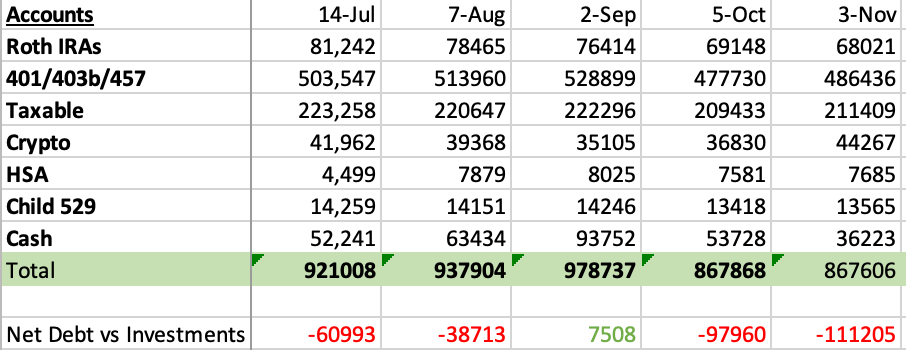

Market was mostly down to flat this month but as you can see still dramatically up for the year as I am mainly invested in growth stocks.

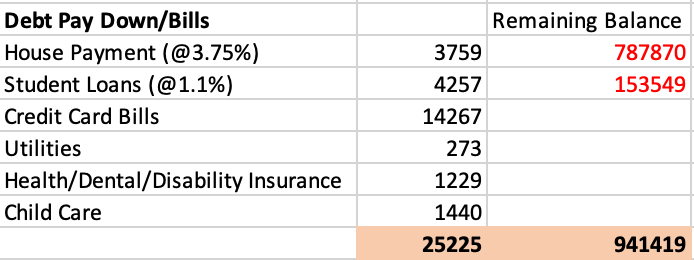

I had some final credit card bills for some extras on the boat this month, everything is now paid off besides some money we are carrying on a zero percent interest CC until next year. I’m hoping we can slowly get to more average spending months. While my income has been great this year, it has still been an expensive one with building a new house, furnishing, dock, boat, etc.

Rebuilding my cash saving account, nothing major besides my wife putting in most of her paychecks into her 401k to try and get it maxed by the end of the year.

Investment Accounts:

I am now focusing the last few months on saving up my cash as I will need to pay quarterly tax bill in January for the rest of the year and start funding my defined benefit plan. Slow and steady.

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash DONE (ok we are holding some on a 0 percent credit card, but only to leverage our HYSA at 5%)

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500 (DONE)

- 529 Plan – Contribute $10,000 (DONE)

- Taxable Account – $60,000 in contributions ($10,000 contributed)

- change in this plan as I have now opened up a DB plan

Buy Rental Home– Single Family Home (on hold for now)- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed (ON TRACK)

-AMJ