About me: I am a full-time emergency medicine doctor a few years out of residency. I am currently working as a full time 1099 independent contractor with a few side hustles here and there. I am married to my beautiful wife, Mrs. AMJ and have one child. I created this blog to track my financial journey. My goal is to maintain a balanced approach to my finances between slowly paying down my low interest debt, investing aggressively, but also enjoying life along the way (IE: Somewhere between frugal and YOLO). Thank you for following along.

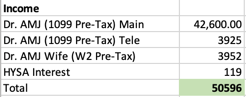

Another packed month of shifts and telemedicine work. My income is on track to exceed $600k this year but I am recognizing this workload is not sustainable long term. My clinical emergency medicine job remains very short staffed and we are all working extra hours. This involves a lot of night shifts and flipping back and forth. The circadian rhythm disruption is really what is getting to me and my group doesn’t pay extra for nocturnist staffing like my old shop.

I am looking into transitioning into more hybrid between clinical ED shifts and telemedicine shifts. This could end up meaning a pay cut but hopefully a more sustainable career. The good news is, my wife will likely work more next year so well be ok!!

Investments:

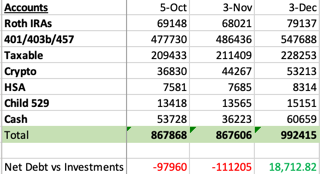

I messed up my personal capital and deleted a bunch of data, ahhh, so the graph below is messed up, however the market had a great month in November with my investments topping $920k

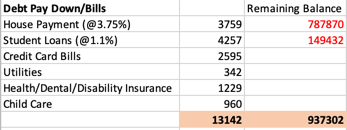

Nothing extraordinary this month. Just the typical bills, thankfully no major expenses (finally)

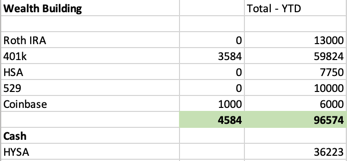

Just typical month for us, my wife is finally getting near maxing her 401k for the year. I dabbled a little in some bitcoin for fun too.

We have made some big strides in our debt and investments this year, especially with such a strong market. I’m hoping to hit 1 million in investments by the end of the year. Essentially my entire income from December will be going to paying quarterly taxes. I will then begin aggressively funding my DB plan to max it out (approximately 88k for 2023).

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash DONE (ok we are holding some on a 0 percent credit card, but only to leverage our HYSA at 5%)

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500 (DONE)

- 529 Plan – Contribute $10,000 (DONE)

- Taxable Account – $60,000 in contributions ($10,000 contributed)

- change in this plan as I have now opened up a DB plan

Buy Rental Home– Single Family Home (on hold for now)- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed (ON TRACK)

-AMJ