How we spent 600k in 2024

About me: I am a full-time emergency medicine doctor a few years out of residency. I am currently working as a full time 1099 independent contractor with a few side hustles here and there. I am married to my beautiful wife, Mrs. AMJ and have one child. I created this blog to track my financial journey. My goal is to maintain a balanced approach to my finances between slowly paying down my low interest debt, investing aggressively, but also enjoying life along the way (IE: Somewhere between frugal and YOLO). Thank you for following along.

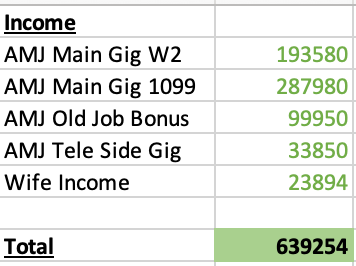

2024 Total Income

I made a lot more than I thought I would. My current job remains very short staffed and thus I’m working quite a bit more than I anticipated. I also got about $100k in bonus payouts from my previous job and a $20k sign on bonus for my new job boosting my income much higher than anticipated. I also converted from a W2 partnership track position to a 1099 which boosted my income about 10k per month higher. I was able to pick up some shifts doing some telemedicine work a few times a month as well.

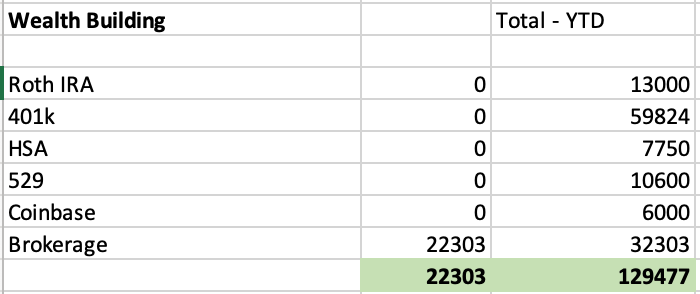

Investments:

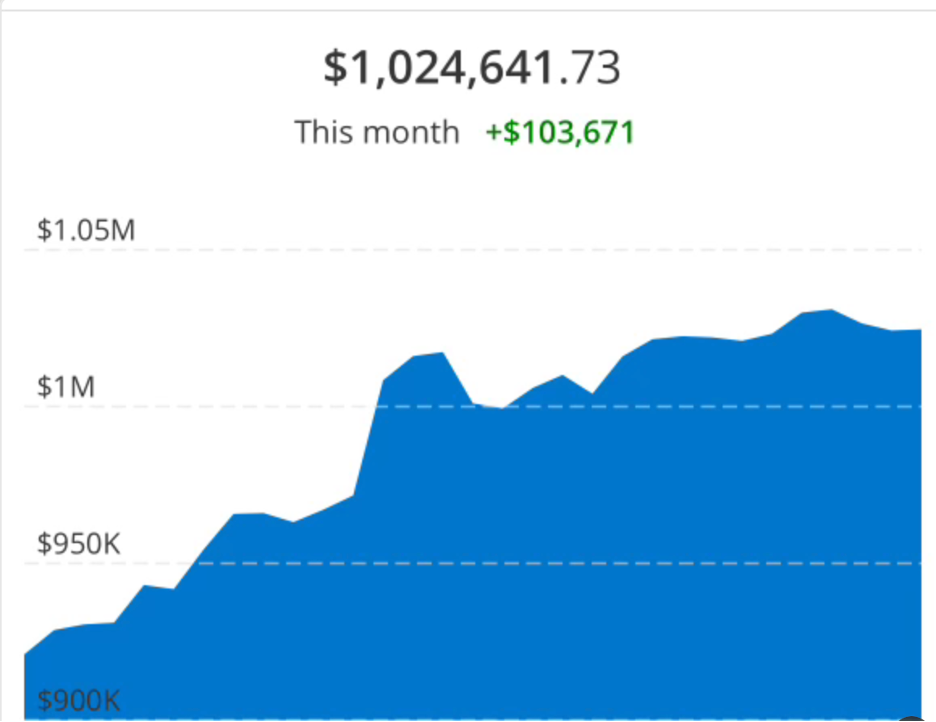

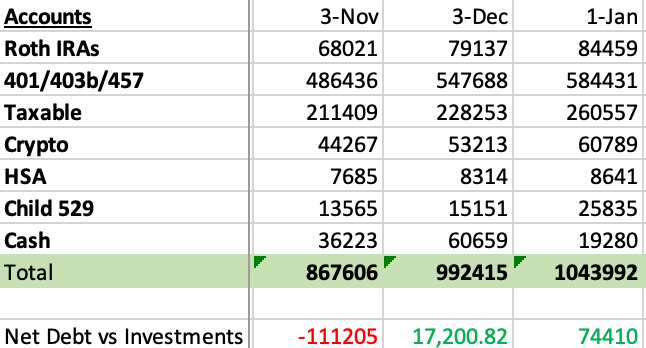

I messed up my personal capital and deleted a bunch of data ahhh, so now only have recent data from December on. Most of my money is invested in growth index funds and ETFs (such as VUG) and it had an absolute monster year (after getting crushed last year), but these funds are up around 40% for the year. Thus my investments have done phenomenally for the year. I began the year at $652k and finishing at $1.024 million, an increase of 372k!

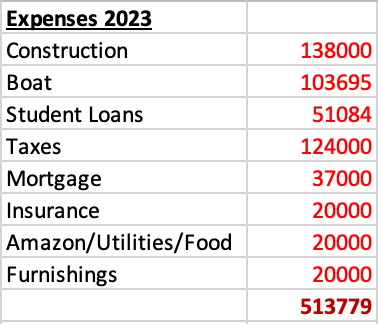

Yearly Expenses

Full disclosure, I don’t track every single dollar so some of these are general estimates besides the major expenses that I have all the receipts for.

This year was a very expensive year for us. My son was born late last year, we moved across the country, built our dream home, a dock and purchased a boat. We worked hard but we also play hard and we are building our dream life. Removing all the construction costs for our home and the boat purchase and our expenses this year will drop 250k. I was still able to invest about $130k into the market.

Investment Accounts:

We officially hit 1 million in investments this year in December. I started the year off with $652k. With the massive returns in growth stocks and another 130k or so invested in the market it was an amazing year for us, an increase of $372k. Lets review my goals from 2023 and look forward to 2024.

My Seven Goals for 2023

- Close on our new house – Pay all final costs and furnishings with cash DONE (ok we are holding some on a 0 percent credit card, but only to leverage our HYSA at 5%)

- Max out Roth IRA x 2 for myself and wife – $13,000 (DONE)

- Max 401k – $22,500 (DONE)

- 529 Plan – Contribute $10,000 (DONE – 20,600 contributed)

- Taxable Account – $60,000 in contributions (Miss- $32,000 contributed)

- change in this plan as I have now opened up a DB plan

- Didn’t quite make it, I will focus on funding my DB plan

- change in this plan as I have now opened up a DB plan

Buy Rental Home– Single Family Home (on hold for now) – MISS- Just too busy, market is too crazy, will think about doing this in the future.

- Make Minimum Student Loan Payments – 4 years left @ 1.1% fixed (DONE)

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- Fully fund all retirement accounts – $168,300

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000

- Family HSA Plan – $8,300

- AMJ and Wife 401ks – $23000 x2 – $46,000

- AMJ 401k Profit Sharing – $10,000

- AMJ Defined Benefit Plan – $90,000

- 529 Fund for son – $10,000

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

- Fully fund all retirement accounts – $168,300

-AMJ