About me: I am a full-time emergency medicine doctor a few years out of residency. I am currently working as a full time 1099 independent contractor with a few side hustles here and there. I am married to my beautiful wife, Mrs. AMJ and have one child. I created this blog to track my financial journey. My goal is to maintain a balanced approach to my finances between slowly paying down my low interest debt, investing aggressively, but also enjoying life along the way (IE: Somewhere between frugal and YOLO). Thank you for following along.

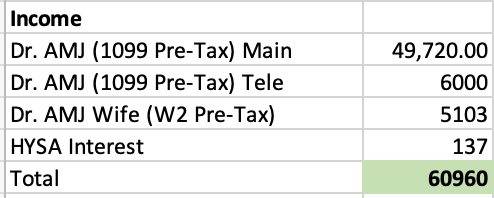

January Total Income:

I worked a ton in January (too much). We continue to be very short staffed at work and I’ve been filing in the holes. My telemedicine gig has also had plenty of available shifts and I honestly enjoy the work and find it very easy to work at home. The bad news however is the contract is ending in February so I’m trying to get as many shifts as I can. I will likely look for another telemedicine side gig starting in March. I spoke with my boss and asked to just work full time hours starting in March so I’m hopeful this will make my career more sustainable. Difficult to say no as there is so much extra work out there.

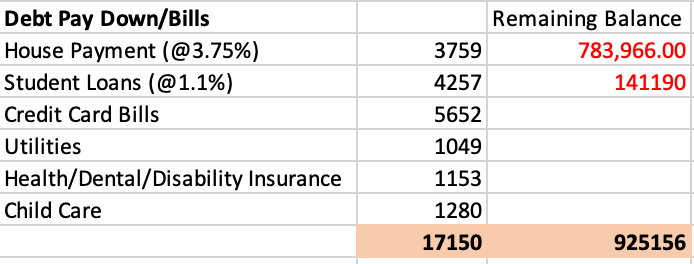

We continue to make minimum payments on my mortgage and student loan debt. I often think about paying a little extra, but investing in the stock market continues to pay off. Once my student loan debt drops under 100k (which will be at the end of this year), I may seriously consider just selling some money in my taxable account and getting rid of it. There is so psychological security in doing so. I also think about maybe upping my mortgage payments by a couple hundred, but haven’t done so yet. I had a lot of licensing expenses in my credit card for my business/LLC that I had to pay off this month.

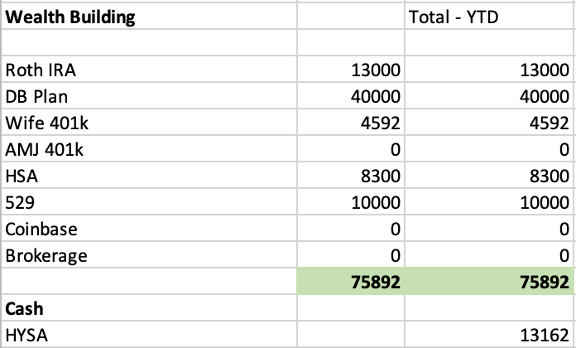

Investments

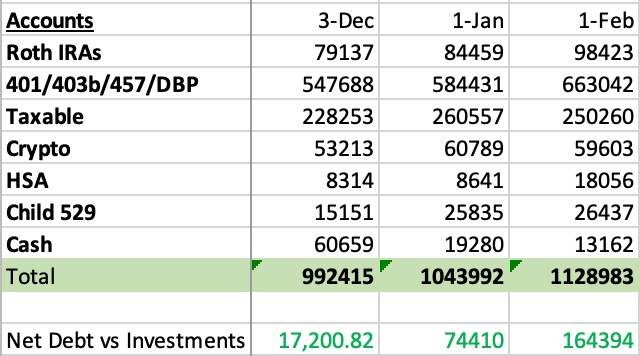

Wow, the stock market has been on an absolute tear these past few months. We remain mainly invested in growth index funds and it is paying off. My only regret is not investing more sooner!

I moved a lot of money out of our HYSA to prefund these accounts maxing out the HSA, Backdoor Roth IRA x2 and my son’s 529. I also am aggressively funding my DB plan as I need to get in $88,500 by tax time, I dropped in 40k this month. I also made a large estimated payment to the IRS (not showing this amount) so my cash/HYSA largely depleted at this time. Will slowly rebuild but want to get my investments funded quickly.

Investment Accounts:

My Seven Goals for 2023

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- I worked over 240 hours in January. I will pull back in March, I hope.

- Fully fund all retirement accounts – $166,800

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000 DONE

- Family HSA Plan – $8,300 DONE

- AMJ and Wife 401ks – $23000 x2 – $4,592 of 46,000 funded

- AMJ 401k Profit Sharing – $0 of 10,000 funded

- AMJ Defined Benefit Plan – $40,000 of $88,500 funded

- 529 Fund for son – $10,000 DONE

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed ON TRACK

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

-AMJ

Love the hustle! I’d do the same out of residency as well.

I’d love to make that type of money now to build back up my liquidity after a house purchase.

Alas, I’ve been too out of the game so I can only make $10,000-20,000 a month at most, probably closer to $12,000.

What’s your net worth goal and retirement age goal? GL on your journey.

Sam

Hey Sam,

Wow, thanks for taking a look at my blog. I love reading your blog and insights. I think I will need around 2.5/3 mil to fully retire early, hopefully somewhere between 40-45 (I’m 35 now). But I think I will always work a bit, just get rid of the painful parts of the job (IE night shifts) and hoping to do that by 40.