About me: I am a full-time emergency medicine doctor a few years out of residency. I am currently working as a full time 1099 independent contractor with a few side hustles here and there. I am married to my beautiful wife, Mrs. AMJ and have one child. I created this blog to track my financial journey. My goal is to maintain a balanced approach to my finances between slowly paying down my low interest debt, investing aggressively, but also enjoying life along the way (IE: Somewhere between frugal and YOLO). Thank you for following along.

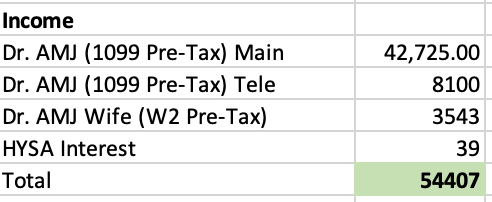

February Total Income:

February was another month of working too much. March 1st will actually be a big change for me. I am going down to full time hours and my telemedicine gig actually lost its contract so I am going from working >20 shifts a month to 13 shifts a month. I feel strangely guilty about doing this, but I just know what I am doing is not sustainable over the long term. I see the partners from the group I work with miserable (even though they are making very good dough). I would rather have a longer more sustainable career (I think) so my hours are going down significantly. I think we are in a financial place where this is now doable. Much of our major expenses for our new house are behind us, we can continue to pay down debt and invest aggressively.

The other major change this month, is my wife was able to go from PRN to part-time meaning she can now get benefits. Her W2 job has much better healthcare (and about $300 cheaper) than my private health insurance I bought as a 1099. She also gets a small 401k match now so lots of wins out there this month!

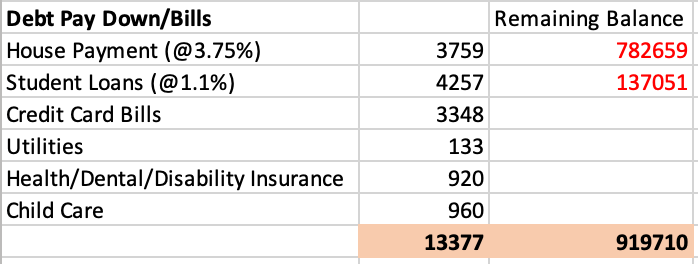

Expenses

No major expenses to report this month, we did go on a tropical vacation for a week with friends but had already paid for most of that last year, outside of food we didn’t have any major expenses there.

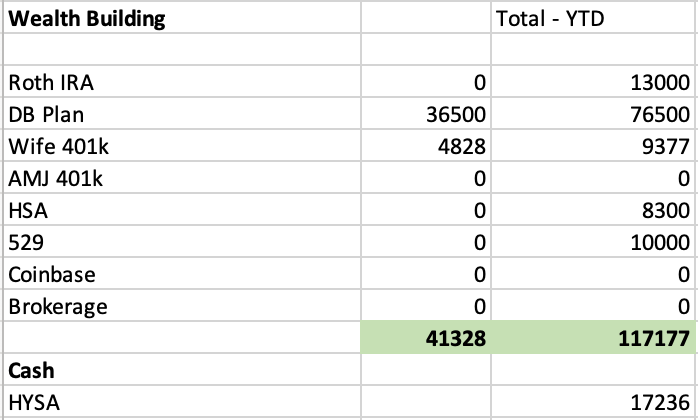

Investments

The market continues on a bull run and my investments are loving it.

I continue to aggressively fund my DB plan, it is now fully funded for 2023 pending my final tax amount from my CPA. My wife also continues to fund her 401k aggressively, our goal is to get those maxed by the end of the year.

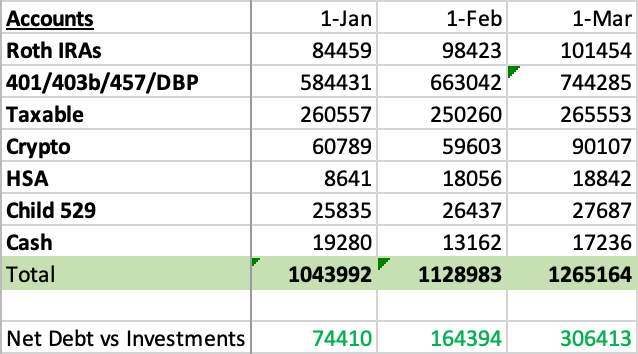

Investment Accounts:

My net worth continues to sky rocket as I pay down my debt and invest aggressively. This time a year ago my debt vs investments was -$300k and is now +$300k. A swing of 600k in one year, unreal to me. Great lesson in staying the course.

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- I’m getting there, I am working much less in March

- Fully fund all retirement accounts – $168,300

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000 DONE

- Family HSA Plan – $8,300 DONE

- AMJ and Wife 401ks – $23000 x2 – $9377 of 46,000 funded

- AMJ 401k Profit Sharing – $0 of 10,000 funded

- AMJ Defined Benefit Plan – $76,500 of $76,500 DONE

- 529 Fund for son – $10,000 DONE

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed ON TRACK

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

-AMJ