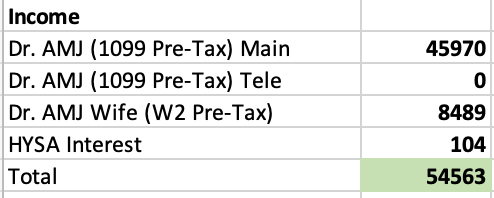

July Total Income:

Another full month of shifts, we didn’t have a lot going on this month (no vacations or friends/family visiting) so I ended up working a few more shifts. My wife also worked quite a bit more and maxed out her 401k for the year!

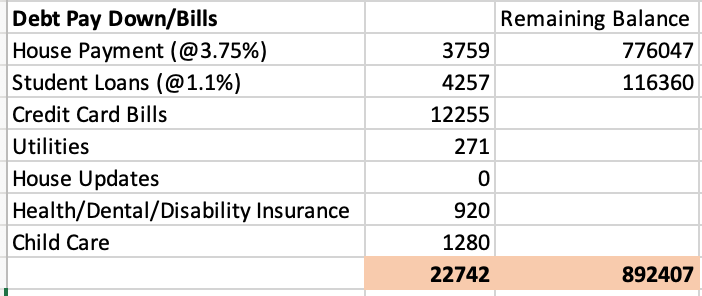

Expenses

Credit card bill is high because I put a deposit down for an Airbnb for a vacation planned with friends later this year. Otherwise our standard expenses. I am getting tempted to pound out my student loans which I think I will do early next year (IE: make 4x payments of 25k over four months and be done), will hurt the savings and mathematically wrong but I feel like the amount of getting small enough that it won’t really make a major difference at this point anyways.

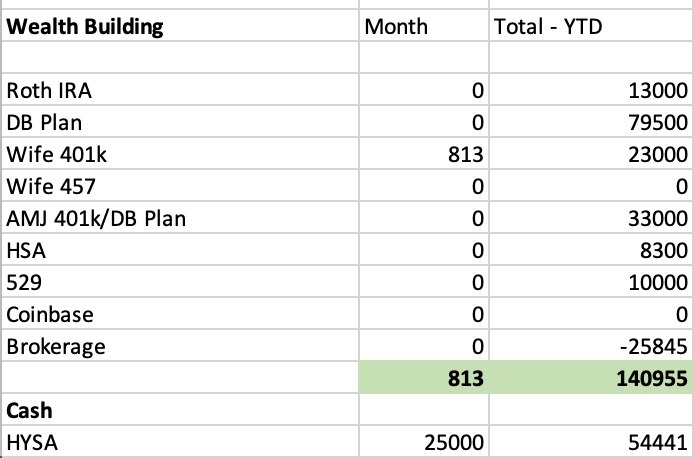

Investments

Markets were mostly flat this month (before things got crazy in August). We continue our upward trend for the year.

My wife’s 401k is now maxed for the year! We have decided to fund her 457 as well which will start this August. I front loaded my retirement savings for the year, I am now building up my HYSA to at least 100k. I need to have cash available for pending tax payments.

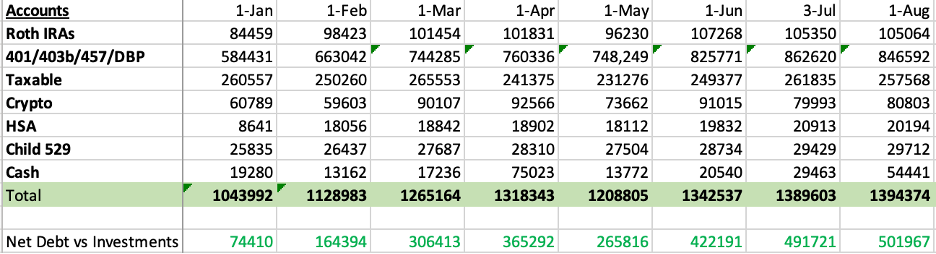

Investment Accounts:

No major moves this month, just a slow trend upward, I broke 500k in my debt vs investments. Look back to July 2023, this number was -60k so I can’t not be happy with that. I don’t include my home in this calculation although maybe I should, the Zestimate is now over 1.6 mil.

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- I still continue to work a lot. I’m trying

- Fully fund all retirement accounts – $168,300 GOAL – DONE

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000 DONE

- Family HSA Plan – $8,300 DONE

- AMJ and Wife 401ks – $23000 x2 – $46,000 of 46,000 funded

- AMJ 401k Profit Sharing – $10,000 of 10,000 funded

- AMJ Defined Benefit Plan – $79,500 of $79,500 DONE

- 529 Fund for son – $10,000 DONE

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed ON TRACK

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

- DONE

-AMJ