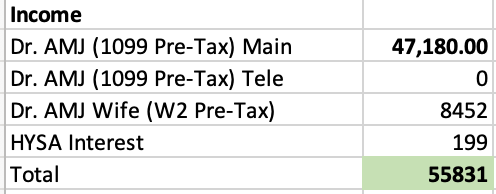

August Total Income:

Busy month of shifts, we didn’t have any major plans this month so we both ended up working a lot. The next few months, we have vacations or friends visiting so planning to kick back a little bit to a more normal schedule.

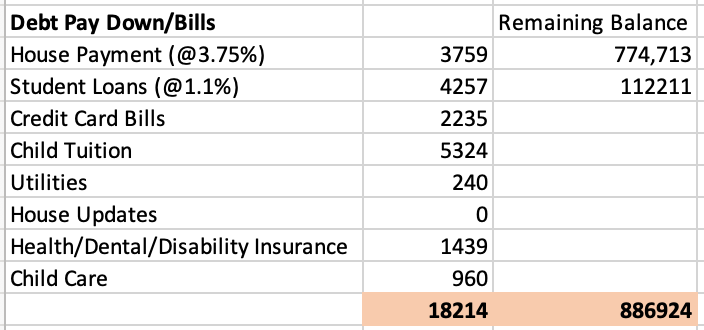

Expenses

Major expense this month was our child’s yearly tution as we enrolled him in school for the first time. I will be able to deduct 5k of this on my tax return which is a nice perk to pay almost all of that pretax. Additionally, I had to pay my yearly life insurance bill (I have a 10 year term 1 mil policy which costs me just over $500/year). We ended up getting a refund for our Airbnb because the trip ended up getting cancelled thus our credit card was much smaller this month.

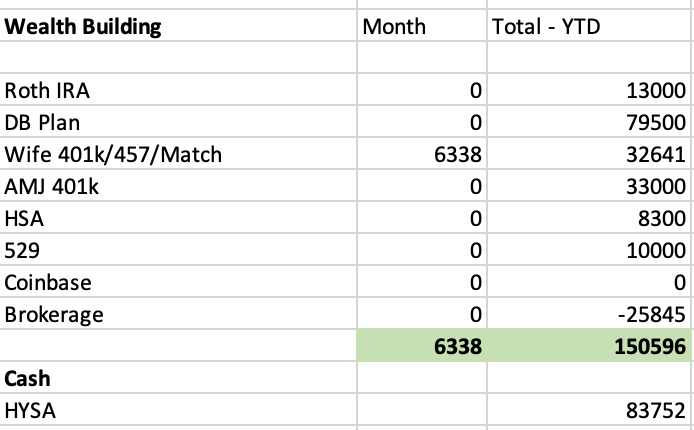

Investments

August was a pretty wild month for the markets, crashing in the beginning and then almost ended up back where we started. Really no change in our investments this month.

My wife has started contributing to her 457. I am starting to save up cash, looking save at least 100k as this will be my approximate year end tax payment for my LLC/S-Corp.

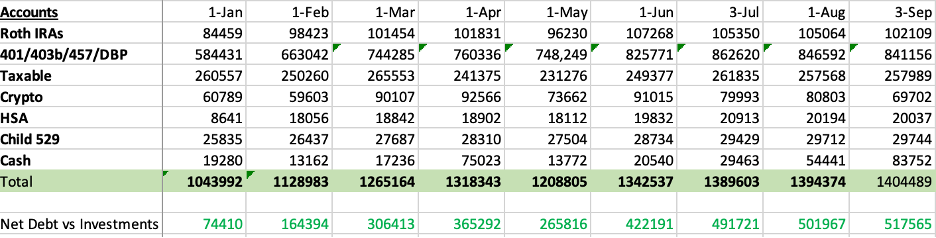

Investment Accounts:

Mostly a flat month as far as investments go. We continue to make minimum investments on our debt payments (mortgage and student loans) and invest as much as possible. I’ve been building up my cash reserve pending my year end tax payment but may deploy some money in the market if we have a big crash. I am also beginning to debate wiping out my student loans (considering like a 25-30k/month payment and knocking it out in 3-4 months). I will likely wait till early next year but I think this may be my next play.

My Financial Goals for 2024

- WORK LESS – I’ve been working like a dog the first few years out of residency, I feel like I’m finally getting to a point where I want to pull back a bit.

- I still continue to work a lot. I’m trying

- Fully fund all retirement accounts – $168,300 GOAL – DONE

- Backdoor Roth IRA x2 – $7000 x 2 – $14,000 DONE

- Family HSA Plan – $8,300 DONE

- AMJ and Wife 401ks – $23000 x2 – $46,000 of 46,000 funded

- AMJ 401k Profit Sharing – $10,000 of 10,000 funded

- AMJ Defined Benefit Plan – $79,500 of $79,500 DONE

- 529 Fund for son – $10,000 DONE

- Make Minimum Student Loan Payments – 3 years left with $149k @ 1.1% rate fixed ON TRACK – Down to 112k left

- Payoff Credit Card Debt – We have about $39,000 in credit card debt, this is all 0% APR but its still a decent amount that we will have to pay off this year.

- DONE

-AMJ